What’s in Today’s Report:

- Why Stocks Rebounded on Thursday

- What’s Next for Russia/Ukraine (From a Market Perspective)

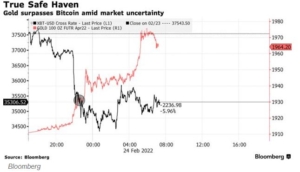

Futures are moderately lower (about 1%) as there were no major changes in Ukraine overnight and as markets digest Thursday’s rebound.

Russian troops have arrived at Kiev and there are reports of heavy fighting near the city, and many analysts expect Kiev to fall as soon as today or in the coming days.

There was no notable economic data overnight.

Today obviously markets will be focused on Ukraine headlines, but as long as there are no signs of the conflict spreading beyond Ukraine then it shouldn’t be too much of a direct impact on stocks. Outside of geo-politics, the key economic report today is the Core PCE Price Index (E: 0.5% m/m, 5.2% y/y) and if that is much stronger than expectations, it will weigh on futures as it will make the Fed more hawkish, and if it shows signs of inflation peaking, it could extend yesterday’s rally. We also get Durable Goods Orders (E: 0.5%), Consumer Sentiment (E: 61.7) and Pending Home Sales (E: 0.8%) but those numbers shouldn’t move markets unless they are large misses vs. expectations.