The Market’s Bell with WSJ Best-Selling Author Simon Constable

WSJ best-selling author Simon Constable puts a little British spin on the US economy where to invest now. He’s fun, brutally honest and wicked smart.

WSJ best-selling author Simon Constable puts a little British spin on the US economy where to invest now. He’s fun, brutally honest and wicked smart.

People on Wall Street have a great sense of humor.

I remember thinking that years ago when I started my career at Merrill Lynch, and despite the fact that we’ve witnessed a lot of changes in this business over the years (most of them not good, in my opinion) I’m happy to say there are still a lot of funny people in this industry.

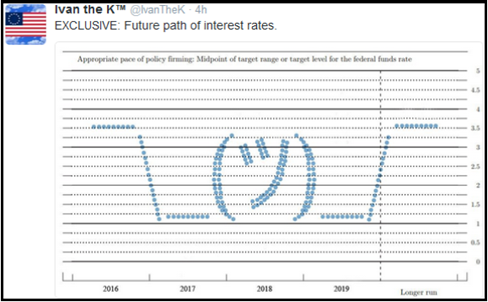

One of them is this guy “IvantheK” who I think is a trader (you never can tell on Twitter).

After the Fed meeting last week, he tweeted this image:

That’s a pretty accurate description of most people’s opinion of Fed policy!

Unfortunately, a dysfunctional Fed isn’t an excuse for advisors (or analysts) to underperform, and blaming a confused Fed for not having a good year won’t keep a client.

So, to keep growing both our businesses (yours and mine), we’ve got to get this market “right’ regardless of how difficult it is.

Given that, I’m happy that we again cut through the noise last week and gave our subscribers the need-to-know information about the Fed and BOJ.

Last week, we said the risk going into these central bank decisions wasn’t that they’d cause a pullback.

Instead, it was that they’d inadvertently put a “cap” on future stock gains.

And, we think that fear was realized because neither central bank was dovish enough to make us think global bond yields will drop towards post-Brexit lows.

And, without that tailwind, our fear is that the S&P 500 is now “stuck” at 2200.

Without the US 10-year Treasury yield heading towards 1%, there isn’t any justification to buy the S&P 500 above 17X earnings (I say the S&P 500 is stuck at 2200 because 17 * $130 (the 2016 S&P 500 EPS) = 2210).

So, in last Thursday’s Report, we said that while the post-FOMC rally was enjoyable, it was just a “relief” rally (relief that the BOJ and Fed weren’t outright “hawkish”) and not indicative of a new bull market.

And, over the past two trading days, the market has validated that analysis as the S&P 500 has retraced the entire post-FOMC rally.

Over the last week, we gave paid subscribers:

And all it took was a 7 minute read each trading day at 7 a.m.!

That’s how we turn our daily macro report into a tool advisors use to grow AUM.

Now that the key events of September are (mostly) behind us, focus is shifting towards the fourth quarter, and while the general consensus on Wall Street is that it could be a quiet few months, there are still several key events looming between now and December 31

that will decide whether the S&P 500 finishes 2016 positive or negative, and we’ve offered an excerpt of that list as a courtesy.

What’s Next for Markets: 5 Key Questions

Nearly six weeks ago in mid-August, when almost every analyst on Wall Street was trying to cram in a little extra vacation time, we told our paid subscribers (and you via these free excerpts) that the period of low volatility was about to end, because starting with the Fed’s Jackson Hole Conference (in late August) we were entering a critical stretch of key events that would largely decide whether stocks resume the July rally or not.

Since then stock volatility has risen sharply and the upward momentum in stocks has been broken.

Now, we’re saying it again:

The rest of the year will likely not be smooth sailing, and there is a lot of potential for volatility.

And with the S&P 500 up just over 4% year to date, there’s not a lot of room for error from a performance standpoint.

We have identified five key questions that, depending on their outcome, will ultimately decide whether the S&P 500 ends 2016 positive or negative:

Question 1: Will the ECB Extend QE? It’s widely assumed the ECB will extend its current QE program in December, but that’s not a given, and if they disappoint markets, we could see a sharp pullback at the worst time – three weeks until year end.

Question 2: Will the BOJ Taper QE This Year? The Bank of Japan basically admitted it’s “out of bullets” last week, so now it’s just a matter of time until they actually reduce their QE program (it’s not working and risks doing more harm than good). If/when the BOJ does taper QE, that will hit stocks.

Question 3: Does the Italian Referendum Pass? This is easily the most important issue for markets you likely haven’t heard about. This vote isn’t the Italian version of Brexit, but it isn’t very far from it, either. Later this year Italy will vote on a series of constitutional reforms, and if the vote fails, that will set up a “Brexit” type vote in 2017.

Question 4: Does the US Election Cause a Surprise? Even after last night’s debate this election will be closer than anyone thought possible, and it has the potential to cause a surprise and rattle markets.

Question 5: Does OPEC Cut Production: Falling oil is still a weight on stocks, so if OPEC does not cut or cap production at tomorrow’s meeting, the last date to do so in 2016 will be in late November. Plunging oil caused a drop in stocks last December, and the potential is there for a repeat.

In tomorrow’s paid subscriber edition of The Sevens Report, we will tell our subscribers the “Need to Know” on each of these looming events including:

It is our hope that subscribers print this section of the report out and tape it to their desks, as it literally will be a road map to help advisors and investors navigate the remainder of the year.

Finally, our paid subscribers know we will monitor these looming events, but more importantly we’ll be watching for macro surprises that aren’t on the calendar – including:

That’s how we are going to help subscribers successfully navigate a volatile fourth quarter, so they can continue to focus on growing their business and strengthening client relationships.

The fourth quarter helps you lay the foundation for more allocations in the New Year, and we’re determined to help advisors “win” in Q4!

What Does This Mean for Markets (Stocks, Bonds, Commodities, Currencies)?

The S&P 500 being capped at 2200 does leave the markets vulnerable to macro shocks.

In fact, this market environment is starting to look at a lot like last year.

From May 2015 to July 2016 the S&P 500 was “capped” at (basically) 2100, and because it was capped, it was susceptible to sharp macro-economic inspired pullbacks:

Obviously the market has recovered from these dips, but if an advisor had been able to tactically reduce exposure during just part of these declines, the cumulative effect on performance would be huge, and that means happy clients and more assets!

That is what we are very focused on doing for our paid subscribers over the next three months.

We are going to make sure they:

If you don’t have a morning report that is going to give you the plain-spoken, practical analysis that will help you navigate the fourth quarter and help you get positioned properly to outperform into year end, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long-term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Increased Market Volatility Will Be an Opportunity for the Informed Advisor and Investor

We aren’t market bears, but we said consistently that things were going to be volatile in 2016, and we were right!

And, as we approach the biggest event for markets since Brexit (the BOJ meeting next Wednesday) the advisor who is able to confidently and directly tell their nervous clients what’s happening with the markets and why stocks are up or down, and what the outlook is beyond the near term (without having to call them back), will be able to retain more clients and close more prospects.

We view volatility as a prime opportunity to help our paid subscribers grow their books and outperform markets

by making sure that every trading day they know:

1) What’s driving markets

2) What it means for all asset classes, and

3) What to do with client portfolios

We monitor just about every market on the globe, break down complex topics, tell you what you need to know, and give you ETFs and single stocks that can both outperform the market and protect client portfolios.

All for $65/month with no long term commitment.

I’m not pointing this out because I’m implying we get everything right.

But we have gotten the market right so far in 2016, and it has helped our subscribers outperform their competition and strengthen their relationships with their clients – because we all know the recent volatility has resulted in some nervous client calls.

Our subscribers were able to confidently tell their clients 1) Why the market was selling off, 2) That they had a plan to hedge if things got materially worse and 3) That they were on top of the situation.

That’s our job, each and every trading day, and we are good at it.

We watch all asset classes to generate clues and insight into the near-term direction of the markets, but our most important job is to remain vigilant to the next decline.

While we spend a lot of time trying to identify what’s really driving markets so our clients can be properly positioned, we also spend a lot of time identifying tactical, macro-based, fundamental opportunities that can help our clients outperform.

If you want research that comes with no long-term commitment, yet provides independent, value-added, plain-English analysis of complex macro topics, click the button below to begin your subscription today.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom Essaye

Editor, The Sevens Report

SL: Is the Bond Bull Market Over? (Central Bank Preview)

In the next 24 hours we’re going to get the answer to two very important questions:

And, it’s the Bank of Japan that likely will decide the answers to those questions, which will decide whether we see a potentially sharp decline in both stocks and bonds.

I’m not one for patting myself on the back, but I don’t know of many other research firms that were pounding the table back in August (when the market was quiet) saying:

So, now I’m reiterating that tomorrow is a potentially very important day for clients’ stock and bond holdings, because even if we don’t see a lot of volatility immediately following the meetings, the Bank of Japan decision may mean the continuation of this rally in global bond yields, and the decline in stocks.

And, that could have significant consequences on clients returns as we enter the fourth quarter.

We are committed to making sure our paid subscribers know, before their competition, whether the Bank of Japan will cause global bond yields to move higher or lower, because that will be the key to getting clients properly positioned to outperform in Q4.

We’ve already delivered our Plain-English BOJ Preview to paid subscribers and they already know:

So, tomorrow, while other advisors and investors are searching WSJ.com, MarketWatch or CNBC to try and determine whether the meetings were bullish or bearish for stocks and bonds, our subscribers will already know.

But, more importantly, our subscribers know that at 7 a.m. Thursday morning we will deliver clear, Plain-English analysis of what the meetings mean for all asset classes (Stocks, Bonds, Commodities, Currencies) in the short and long term, and what tactical ETFs or general allocations we think will outperform in Q4 and beyond (and if that means raising cash, we’ll say it!).

Our paid subscribers won’t have to wait for a delayed, compliance-approved recap from their brokerage firm that just explains what the BOJ or Fed did, and ignores how to either protect gains or profit from the decisions.

We are going to tell our subscribers (at 7 a.m., and in plain English): 1) What Happened, 2) What it Means for Client Holdings (Stocks, Bonds, OI, Gold, the Dollar) and 3) How We Think We Can Make Money from It.

And, because this is such an important time for markets, we will be hosting a special webinar this Thursday at 1 P.M. EDT titled: “Breakout or Breakdown? 4th Quarter Market Preview.”

We will discuss the outlook for both stocks and bonds (and how we think investors should be positioned) heading into the 4th quarter.

There are a lot of moving pieces to tomorrow’s BOJ meeting and there aren’t a lot of clear, easy-to-read previews out there, so I’ve included an excerpt of our BOJ Preview as a courtesy:

BOJ Preview: What’s Expected

The fear going into tomorrow’s meeting will be that the BOJ will tacitly admit that it is indeed out of bullets, and is no longer able to provide meaningful stimulus to the Japanese economy. And while Japan is a unique case, this matters to all developed stock markets for two reasons.

Bottom line, for global stock and bond markets that have been driven higher by the expectation of forever-low rates and ever-increasing central bank stimulus, having the most active player tacitly admit defeat is not good.

Now that we have the context, let’s look at what’s expected (there are a lot of moving pieces here, so bear with me):

Wildcard to Watch: If the BOJ increases the inflation target from 2% to 3% (or close to 3%) that will be a surprise dovish move, and be taken as an unexpected positive (positive for stocks, negative for global bond yields).

Have a Plan In Place If Yields Keep Rising (and Stocks Keep Falling)

If you’re like me, and most advisors and investors, the biggest risk for tomorrow’s meetings is that global bond yields keep rising and stocks keep falling, creating an extension of the past 10 days where both stocks and bond holdings are falling together.

Given that risk, we spent last week providing subscribers with our “Higher Rate Playbook” they can refer to if we see that negative outcome, because in that scenario protecting profits and finding sectors that can outperform will be critically important! Paid subscribers already have this tactical playbook they can refer to, because we all know thinking clearly gets much more difficult when markets are falling!

Play #1: Get Short the Long End of the Yield Curve, and/or Reduce the Overall Duration in any Bond Ladders

If we see a sustained decline in bonds/rally in yields, the belly and long end of the yield curve will get hit much harder than the short end of the yield curve.

There are two reasons for this:

First, the long end (say beyond 10 years) is over inflated because of foreign money, and as such has a lot further to fall before we get to compelling values.

Second, the short end of the curve (really 2 years or less) trades off Fed expectations, and the Fed simply isn’t going to raise rates quickly regardless of what happens in the markets (and especially if we see a selloff in stocks). So, the Fed will anchor the short end of the yield curve while the longer end rises, meaning the declines in short-term bonds will be less than in longer-term bonds.

ETFs to Get “Short” the Long Bond (there are many ETFs to do this but this is a list of the most liquid and targeted): Restricted for Subscribers

What to Buy in the Bond Markets: Restricted for Subscribers.

We don’t think everything in the bond market is toxic and we continue to have a top pick in the fixed income market for incremental capital that is less than five-year duration and the best alternative in a bond market that may be broadly declining.

Play #2: Focus on Good (but not Great) Credit Quality in Corporates

First, I think there may be opportunities for additional yield in the tier right below the top end of investment grade.

Point being, I would take the extra yield in that space between AAAs and junk, because barring a broad economic slowdown, corporate balance sheets are as strong as they’ve been in years.

Second, if I had a large allocation to junk bonds, I would rotate into higher-quality corporates because junk will get hit, and hit hard, in a declining bond market (think of junk bonds as the “subprime” of the bond market). Yes, junk pays a good yield, but in a rising rate environment it’s not worth the incremental risk.

How to Get Short Junk Bonds: Restricted for Subscribers.

How to Put on a Long Investment Grade/Short Junk Spread:

Restricted for Subscribers.

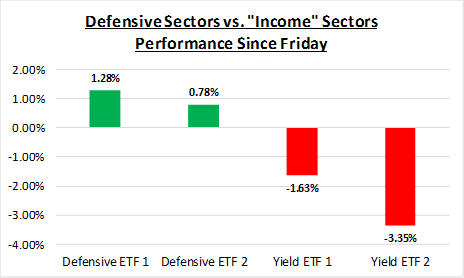

Play 3: Shift Exposure in US Stocks Out of “Yield Proxy Sectors.” (Know the difference between high-yielding sectors and truly defensive sectors).

If bonds and stocks keep falling, sector selection is going to become very important, and knowing the difference between truly “defensive” sectors vs. sectors that pay big dividends will matter for performance.

We provided the specific defensive sectors we like to paid subscribers in a report last week.

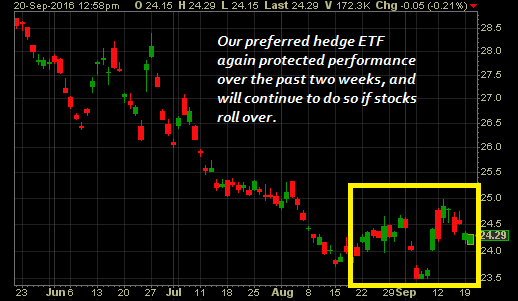

Play 4: Get a General Hedge Against “Risk Off.”

For over a year now we’ve used a specific inverse ETF as a broad hedge against a “risk-off” move in stocks, as this ETF has direct, specific exposure to some of the weakest sectors of the market, and as such can cushion any broad declines in the markets (like we saw in August/December 2015 and in January/February 2016).

We provided this specific ETF to subscribers once again in a report last week.

To be clear, I’m not advocating taking any of these steps right now, as it’s simply not clear that the bond market has indeed turned. So, we have to be wary of (another) head fake in this multi-year bull market.

But, if the bond market does turn and 10-year Treasury yield moves towards 2%, it is important that advisors have a plan before the declines start, because things could get ugly quickly.

If you don’t have a morning report that is going to give you the plain-spoken, practical analysis that will help you navigate the BOJ and Fed decisions tomorrow, and help you get positioned properly to outperform into year end, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long-term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Finish 2016 Strong!

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.”

– Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report

Eight years ago today, Lehman Brothers declared bankruptcy and, in my opinion, this business hasn’t been the same since.

That event, and the subsequent fallout, forever changed the way I analyze and invest in the markets, and I bet that’s true for you and your clients as well.

For me, the biggest change pre-Lehman to post-Lehman was the realization that the worst-case scenario can happen, so you can’t be dismissive of it regardless of how low the probability.

That’s one of the reasons that I produce The Sevens Report

– because I want to make sure our subscribers have someone watching their back and looking for risks to client portfolios across asset classes.

And, that’s sometimes why some people think I’m bearish.

I’m not bearish, but one of my main jobs is to make sure that my subscribers aren’t blindsided by seemingly obscure macro risks (like the ECB or BOJ).

That’s also why we spend hours each day watching stocks, bonds, commodities, currencies and economic data so that we can tell our subscribers when risks are materializing, and so we can suggest strategies to protect client portfolios and profit from market conditions.

And, that’s why three weeks ago we told subscribers not to be fooled by a quiet market, and alerted them to the fact that there were critical central bank events looming in September.

So far, we’ve been right:

You know by now that next week’s meetings are key because if the Bank of Japan disappoints markets and the Fed is “hawkish,” bond yields will keep rising and stocks will keep falling.

But, just knowing that isn’t enough.

Advisors needs to have a plan in place to protect client portfolios if the selling gets worse.

That’s why earlier this morning we included, in the regular daily Sevens Report, a “higher rate” playbook of ETFs that will protect client portfolios if the decline in bonds and stocks continues or accelerates.

So, not only have we given our paid subscribers:

1) The information and talking points that show clients and prospects they understand the markets and weren’t surprised by the volatility, but also

2) A specific, tactical plan to protect client portfolios and maintain performance, should these events cause a significant pullback in stocks and bonds.

That’s how we make The Sevens Report

more than just a daily research report, and instead make it a tool that advisors use to get more assets and grow AUM.

Understanding how to be positioned should we see a continued decline in both stocks and bonds is critically important if an advisor or investor wants to successfully navigate these markets in the fourth quarter, and I’ve included an excerpt of that research below as a courtesy.

Higher Rate Playbook Part 1 (Sevens Report Excerpt)

Let me be perfectly clear: The major risk I see to portfolios right now is that we see a continuation of last week – namely both stocks and bonds decline together.

Given that, I want to lay out a general “playbook” of what to do if we do see bonds breakdown materially (which likely will drag stocks down).

Now, to be clear, I’m not saying execute on this today. But I do want to produce a list of ETFs and strategies that everyone can refer back to should we see bonds drop further.

Play #1: Get Short the Long End of the Yield Curve, and/or Reduce the Overall Duration in any Bond Ladders

If we see a sustained decline in bonds/rally in yields, the belly and long end of the yield curve will get hit much harder than the short end of the yield curve.

There are two reasons for this:

First, the long end (say beyond 10 years) is over inflated because of foreign money, and as such has a lot further to fall before we get to compelling values.

Second, the short end of the curve (really 2 years or less) trades off Fed expectations, and the Fed simply isn’t going to raise rates quickly regardless of what happens in the markets (and especially if we see a selloff in stocks). So, the Fed will anchor the short end of the yield curve while the longer end rises, meaning the declines in short-term bonds will be less than in longer-term bonds.

ETFs to Get “Short” the Long Bond (there are many ETFs to do this but this is a list of the most liquid and targeted): Restricted for Subscribers

What to Buy in the Bond Markets: We don’t think everything in the bond market is toxic and we continue to have a top pick in the fixed income market for incremental capital that is less than 5-year duration and the best alternative in a bond market that may be broadly declining.

Play #2: Focus on Good (but not Great) Credit Quality in Corporates

On the corporate side, there will be broad pressure on all corporate bonds if Treasuries decline, but that doesn’t mean there won’t be attractive yields in certain corners of the corporate bond market.

Money will likely initially rotate into very high-quality corporates as it exits Treasuries, so we could see yields in AAA bonds fall and become unattractive. But I think there may be opportunities for additional yield in the tier right below the top end of investment grade.

Point being, I would take the extra yield in that space between AAAs and junk, because barring a broad economic slowdown, corporate balance sheets are as strong as they’ve been in years.

That said, I would not reach for yield into the junk market.

In fact, if I had a large allocation to junk bonds, I would rotate into higher-quality corporates because junk will get hit, and hit hard, in a declining bond market (think of junk bonds as the “subprime” of the bond market). Yes, junk pays a good yield, but in a rising rate environment it’s not worth the incremental risk.

How to Get Short Junk Bonds:

Restricted for Subscribers.

How to Put on a Long Investment Grade/Short Junk Spread:

Restricted for Subscribers.

Play 3: Shift Exposure in US Stocks Out of “Yield Proxy Sectors.” (Know the difference between high-yielding sectors and truly defensive sectors).

Included in tomorrow’s paid edition of The Sevens Report.

If bonds and stocks keep falling, sector selection is going to become very important, and knowing the difference between truly “defensive” sectors vs. sectors that pay big dividends will matter for performance.

We will detail the specific defensive sectors we like in tomorrow’s report.

Play 4: Get a General Hedge Against “Risk Off.”

Included in tomorrow’s paid edition of The Sevens Report.

For over a year now we’ve used a specific inverse ETF as a broad hedge against a “risk off” move in stocks, as this ETF has direct, specific exposure to some of the weakest sectors of the market, and as such can cushion any broad declines in the markets (like we saw in August/December 2015 and in January/February 2016).

To be clear, I’m not advocating taking any of these steps right now, as it’s simply not clear that the bond market has indeed turned. So, we have to be wary of (another) head fake in this multi-year bull market.

But, if the bond market does turn and 10-year Treasury yield moves towards 2%, it is important that advisors have a plan before the declines start, because things could get ugly quickly.

Increased Market Volatility Will Be an Opportunity for the Informed Advisor and Investor

We aren’t market bears, but we said consistently that things were going to be volatile in 2016, and we were right!

And, as we approach the biggest event for markets since Brexit (the BOJ meeting next Wednesday) the advisor who is able to confidently and directly tell their nervous clients what’s happening with the markets and why stocks are up or down, and what the outlook is beyond the near term (without having to call them back), will be able to retain more clients and close more prospects.

We view volatility as a prime opportunity to help our paid subscribers grow their books and outperform markets

by making sure that every trading day they know:

1) What’s driving markets

2) What it means for all asset classes, and

3) What to do with client portfolios.

We monitor just about every market on the globe, break down complex topics, tell you what you need to know, and give you ETFs and single stocks that can both outperform the market and protect client portfolios.

All for $65/month with no long term commitment.

I’m not pointing this out because I’m implying we get everything right.

But we have gotten the market right so far in 2016, and it has helped our subscribers outperform their competition and strengthen their relationships with their clients – because we all know the recent volatility has resulted in some nervous client calls.

Our subscribers were able to confidently tell their clients 1) Why the market was selling off, 2) That they had a plan to hedge if things got materially worse and 3) That they were on top of the situation.

That’s our job, each and every trading day, and we are good at it. We watch all asset classes to generate clues and insight into the near-term direction of the markets, but our most important job is to remain vigilant to the next decline.

While we spend a lot of time trying to identify what’s really driving markets so our clients can be properly positioned, we also spend a lot of time identifying tactical, macro-based, fundamental opportunities that can help our clients outperform.

If you want research that comes with no long-term commitment, yet provides independent, value added, plain English analysis of complex macro topics, click the button below to begin your subscription today.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report

Another great “The Market’s Bell” with Special Guest Randy Frederick, Charles Schwab’s Head of Trading:

-Randy like “collars” on stock positions –long put/short call– ahead of several upcoming events

-Argues our obsession with The Fed is totally out-of-hand

-Explains why too many of us leave money on the table long-term.

Get updates at – http://www.MarketsBell.com

Something potentially very important just happened with the 10-year Treasury yield.

It broke a downtrend in place since the start of 2016, and if it can hold this breakout through the Bank of Japan and Fed meeting next week, it will be a strong signal that the bond bull market may be ending, and interest rates may be (finally) moving higher.

I’m under no illusions that bonds aren’t exactly the most exciting topic in the markets, but the reason we keep focusing on the action in the bond markets is because what bond yields do from here will

be critically important for how stocks and bonds perform in Q4.

Stocks have pulled back a bit recently as bond yields have risen, but the potential is still there for either a continued melt up (at which point advisors are going to want to be very long) or a potentially violent pullback in both stocks and bonds (at which point advisors are going to want to be very defensive).

So, with the BOJ and Fed meeting looming next week and the first presidential debate the week after that, the rest of September will be an especially critical time if you are an advisor or investor who has underperformed markets so far in 2016 (and there are a lot of very good advisors who have underperformed this difficult market), as these events will present an opportunity to close that performance gap… if you know what’s happening and how to be positioned.

And, we’ve seen that over the past few weeks. Banks and other “higher-rate sensitive” sectors have massively outperformed, while tech and higher beta allocations have lagged, rewarding cautious advisors and investors who didn’t chase markets higher in late July/August.

We are going to be very focused on making sure our paid subscribers know, immediately, what the implications are for each of these key events,

and which sectors will benefit from those events, whether it’s banks, consumer staples, utilities, tech or inverse ETFs.

In tomorrow’s edition of The Sevens Report

we are going to be providing a “Higher Rate Playbook” for paid subscribers that details (with specific ETFs):

1) How to hedge a higher interest rate driven decline in stocks,

2) Which market sectors will outperform in a higher rate environment, and

3) What parts of the bond market will outperform and underperform in a rising rate environment.

Look, it’s been a very tough year to beat lazy indexing, but we recognize the chance to make up ground over the coming weeks, and into Q4 and we’re going to be focused on helping our advisor subscribers do just that by making sure they have the need-to-know analysis of all asset classes and global regions, not just US economics or the Fed.

We’re approaching the one-year anniversary of the August 2015 collapse in stocks, and while markets are higher (finally), so is volatility, as international events exert greater influence over the Fed, the US economy, and the US stock market.

We understand that in this market, clients’ assets are at the mercy of the BOJ, ECB, Italian banks, Chinese policy makers, etc., and that’s why, every day, we make sure our paid subscribers know the key trends in:

It’s only by providing that 360-degree coverage, every day, that advisors and investors can truly have an understanding of the risks and opportunities for their portfolios in this environment.

The end of the bond bull market has been called many times by analysts over the past several years, and while I’m not about to do that today (the benefit of the doubt remains with the bulls) there is a subtle but important change in the markets that may signal the lows in Treasury yields are in for a long, long time.

Another Nail in the Bond Bubble Coffin?

Hopefully by now we’ve driven home the point that next week’s BOJ meeting is the most important event on the calendar since Brexit, because if the BOJ disappoints markets it’ll send Japanese bond yields higher, which will pull Treasury yields higher and hurt stocks.

But, even if the BOJ chooses to do more stimulus, we still may have seen the lows in global bond yields for a very long time.

The reason?

Currency hedging (and Las Vegas).

Longer-term readers know that foreign buying of Treasuries has been a massively positive influence on Treasury prices/negative influence on yields.

One of the reasons foreign buyers have gobbled up Treasuries over the past several years was because it was very easy and cheap to hedge out the currency exposure (a German portfolio manager who bought Treasuries was also buying dollars, and that represented an additional risk he or she would want to hedge out, so it became a pure yield play).

But too much of a good thing can become a problem, and in this case the ocean of foreign money flowing into Treasuries, all looking for the same currency hedge, has caused a problem.

For those who follow sports, it’s the same problem bookies have each week when betting the spreads.

In Las Vegas, when too much money goes towards one team, bookies have to adjust the point spread to make a bet on the other team more attractive.

That’s why betting spreads move during the week, as the bookies are always trying to make the amount bet on Team A equal to the amount bet on Team B. That way the bookies have no risk and just collect fees. It’s similar with currency dealers and trading desks.

To bring it back to the markets, if everyone wanted to hedge out the risk of the euro or yen strengthening vs. their Treasury positions, the bets become too one sided and the currency dealers and trading desks have to increase their fees to insulate themselves against losses.

That has been occurring in the foreign exchange markets over the past several months, and at this point, according to reports from Deutsche Bank and Reuters (and I’ve read similar articles from other firms), it now costs so much to hedge out that foreign exchange risk that it has totally offset the additional yield you get in Treasuries over other government debt.

Basically, the “Long Treasuries” trade has become too crowded, and isn’t worth it anymore.

That’s important for advisors and their clients for one simple reason:

It means that a major source of demand for Treasuries has been diminished, which is Treasury negative regardless of what the Fed or BOJ does next week.

Have a Plan in Place if Stocks and Bonds Drop

Let me be clear: If the BOJ disappoints markets next week, both stocks and bonds will drop. But, even if the BOJ does unleash more stimulus, depending on what happens with global bond yields, we still could see Treasury yields rise (or at least not fall very much).

We are committed to making sure our paid subscribers have a strategy to protect client portfolios in either environment, and that’s why tomorrow, we are going to be providing a “Higher Rate Playbook” for them that details (with specific ETFs):

1) How to hedge a higher interest rate driven decline in stocks,

2) Which market sectors will outperform in a higher rate environment, and

3) What parts of the bond market will outperform and underperform in a rising rate environment.

If all we do is help you navigate the next six weeks correctly and help you get properly positioned in client accounts for the fourth quarter, we will have more than covered our subscription cost.

If you don’t have a morning report that is going to give you the plain-spoken, practical analysis that will help you navigate the coming weeks and help you get positioned properly to outperform into year end, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long-term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Finish 2016 Strong!

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.”

– Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report

4880 Donald Ross Rd., Suite 210

Palm Beach Gardens, FL 33418

info@sevensreport.com

(561) 408-0918