Higher Rate Playbook

Eight years ago today, Lehman Brothers declared bankruptcy and, in my opinion, this business hasn’t been the same since.

That event, and the subsequent fallout, forever changed the way I analyze and invest in the markets, and I bet that’s true for you and your clients as well.

For me, the biggest change pre-Lehman to post-Lehman was the realization that the worst-case scenario can happen, so you can’t be dismissive of it regardless of how low the probability.

That’s one of the reasons that I produce The Sevens Report

– because I want to make sure our subscribers have someone watching their back and looking for risks to client portfolios across asset classes.

And, that’s sometimes why some people think I’m bearish.

I’m not bearish, but one of my main jobs is to make sure that my subscribers aren’t blindsided by seemingly obscure macro risks (like the ECB or BOJ).

That’s also why we spend hours each day watching stocks, bonds, commodities, currencies and economic data so that we can tell our subscribers when risks are materializing, and so we can suggest strategies to protect client portfolios and profit from market conditions.

And, that’s why three weeks ago we told subscribers not to be fooled by a quiet market, and alerted them to the fact that there were critical central bank events looming in September.

So far, we’ve been right:

- Fed Jackson Hole Conference August 26th: Will Yellen be “dovish” in her speech? Result: Bearish. Yellen was dovish, but Fed Vice Chair Fischer was “hawkish” and put a September rate hike on the table, causing a drop in stocks.

- The ECB Meeting September 8th: Will the ECB hint at more stimulus (bullish) or not (bearish)? Result: Bearish. The ECB did not hint at more stimulus and that has contributed to this pullback in stocks.

- The Fed Meeting September 21st: Will the Fed hike rates (very bearish), hint at hiking rates in December (bearish) or stay ultra-dovish (bullish)?

- The Bank of Japan Meeting September 21st: Will the BOJ adopt “Helicopter Money Light” (bullish), or just do another inconsequential easing like in July (bearish).

You know by now that next week’s meetings are key because if the Bank of Japan disappoints markets and the Fed is “hawkish,” bond yields will keep rising and stocks will keep falling.

But, just knowing that isn’t enough.

Advisors needs to have a plan in place to protect client portfolios if the selling gets worse.

That’s why earlier this morning we included, in the regular daily Sevens Report, a “higher rate” playbook of ETFs that will protect client portfolios if the decline in bonds and stocks continues or accelerates.

So, not only have we given our paid subscribers:

1) The information and talking points that show clients and prospects they understand the markets and weren’t surprised by the volatility, but also

2) A specific, tactical plan to protect client portfolios and maintain performance, should these events cause a significant pullback in stocks and bonds.

That’s how we make The Sevens Report

more than just a daily research report, and instead make it a tool that advisors use to get more assets and grow AUM.

Understanding how to be positioned should we see a continued decline in both stocks and bonds is critically important if an advisor or investor wants to successfully navigate these markets in the fourth quarter, and I’ve included an excerpt of that research below as a courtesy.

Higher Rate Playbook Part 1 (Sevens Report Excerpt)

Let me be perfectly clear: The major risk I see to portfolios right now is that we see a continuation of last week – namely both stocks and bonds decline together.

Given that, I want to lay out a general “playbook” of what to do if we do see bonds breakdown materially (which likely will drag stocks down).

Now, to be clear, I’m not saying execute on this today. But I do want to produce a list of ETFs and strategies that everyone can refer back to should we see bonds drop further.

Play #1: Get Short the Long End of the Yield Curve, and/or Reduce the Overall Duration in any Bond Ladders

If we see a sustained decline in bonds/rally in yields, the belly and long end of the yield curve will get hit much harder than the short end of the yield curve.

There are two reasons for this:

First, the long end (say beyond 10 years) is over inflated because of foreign money, and as such has a lot further to fall before we get to compelling values.

Second, the short end of the curve (really 2 years or less) trades off Fed expectations, and the Fed simply isn’t going to raise rates quickly regardless of what happens in the markets (and especially if we see a selloff in stocks). So, the Fed will anchor the short end of the yield curve while the longer end rises, meaning the declines in short-term bonds will be less than in longer-term bonds.

ETFs to Get “Short” the Long Bond (there are many ETFs to do this but this is a list of the most liquid and targeted): Restricted for Subscribers

What to Buy in the Bond Markets: We don’t think everything in the bond market is toxic and we continue to have a top pick in the fixed income market for incremental capital that is less than 5-year duration and the best alternative in a bond market that may be broadly declining.

Play #2: Focus on Good (but not Great) Credit Quality in Corporates

On the corporate side, there will be broad pressure on all corporate bonds if Treasuries decline, but that doesn’t mean there won’t be attractive yields in certain corners of the corporate bond market.

Money will likely initially rotate into very high-quality corporates as it exits Treasuries, so we could see yields in AAA bonds fall and become unattractive. But I think there may be opportunities for additional yield in the tier right below the top end of investment grade.

Point being, I would take the extra yield in that space between AAAs and junk, because barring a broad economic slowdown, corporate balance sheets are as strong as they’ve been in years.

That said, I would not reach for yield into the junk market.

In fact, if I had a large allocation to junk bonds, I would rotate into higher-quality corporates because junk will get hit, and hit hard, in a declining bond market (think of junk bonds as the “subprime” of the bond market). Yes, junk pays a good yield, but in a rising rate environment it’s not worth the incremental risk.

How to Get Short Junk Bonds:

Restricted for Subscribers.

How to Put on a Long Investment Grade/Short Junk Spread:

Restricted for Subscribers.

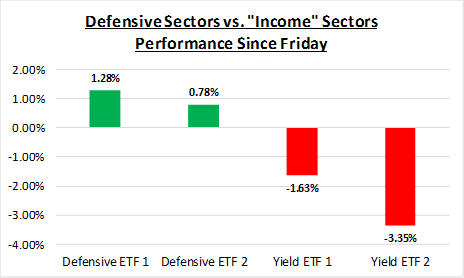

Play 3: Shift Exposure in US Stocks Out of “Yield Proxy Sectors.” (Know the difference between high-yielding sectors and truly defensive sectors).

Included in tomorrow’s paid edition of The Sevens Report.

If bonds and stocks keep falling, sector selection is going to become very important, and knowing the difference between truly “defensive” sectors vs. sectors that pay big dividends will matter for performance.

We will detail the specific defensive sectors we like in tomorrow’s report.

Play 4: Get a General Hedge Against “Risk Off.”

Included in tomorrow’s paid edition of The Sevens Report.

For over a year now we’ve used a specific inverse ETF as a broad hedge against a “risk off” move in stocks, as this ETF has direct, specific exposure to some of the weakest sectors of the market, and as such can cushion any broad declines in the markets (like we saw in August/December 2015 and in January/February 2016).

To be clear, I’m not advocating taking any of these steps right now, as it’s simply not clear that the bond market has indeed turned. So, we have to be wary of (another) head fake in this multi-year bull market.

But, if the bond market does turn and 10-year Treasury yield moves towards 2%, it is important that advisors have a plan before the declines start, because things could get ugly quickly.

Increased Market Volatility Will Be an Opportunity for the Informed Advisor and Investor

We aren’t market bears, but we said consistently that things were going to be volatile in 2016, and we were right!

And, as we approach the biggest event for markets since Brexit (the BOJ meeting next Wednesday) the advisor who is able to confidently and directly tell their nervous clients what’s happening with the markets and why stocks are up or down, and what the outlook is beyond the near term (without having to call them back), will be able to retain more clients and close more prospects.

We view volatility as a prime opportunity to help our paid subscribers grow their books and outperform markets

by making sure that every trading day they know:

1) What’s driving markets

2) What it means for all asset classes, and

3) What to do with client portfolios.

We monitor just about every market on the globe, break down complex topics, tell you what you need to know, and give you ETFs and single stocks that can both outperform the market and protect client portfolios.

All for $65/month with no long term commitment.

I’m not pointing this out because I’m implying we get everything right.

But we have gotten the market right so far in 2016, and it has helped our subscribers outperform their competition and strengthen their relationships with their clients – because we all know the recent volatility has resulted in some nervous client calls.

Our subscribers were able to confidently tell their clients 1) Why the market was selling off, 2) That they had a plan to hedge if things got materially worse and 3) That they were on top of the situation.

That’s our job, each and every trading day, and we are good at it. We watch all asset classes to generate clues and insight into the near-term direction of the markets, but our most important job is to remain vigilant to the next decline.

While we spend a lot of time trying to identify what’s really driving markets so our clients can be properly positioned, we also spend a lot of time identifying tactical, macro-based, fundamental opportunities that can help our clients outperform.

If you want research that comes with no long-term commitment, yet provides independent, value added, plain English analysis of complex macro topics, click the button below to begin your subscription today.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report