What the Employment Cost Index Suggests About Inflation Rates

Boring But Important: Employment Cost Index

Part of our job is to watch indicators that are important and often overlooked by financial media and other research sites.

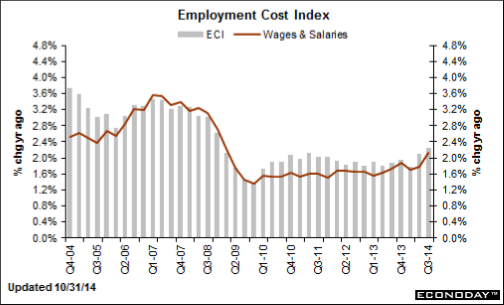

To that end, an overlooked but important number came Friday via the Employment Cost Index (ECI), a quarterly reading of employment costs and wage trends. The ECI rose +0.7% in Q3 vs. (E) +0.5%, and is up +2.2% year-over-year. Specifically the wages and salary component rose +0.8% q/q, the largest quarterly gain since ‘08.

A similar jump in wages and employment costs caught the market off-guard in July and led to a temporary spike higher in yields. That didn’t happen Friday because, as we’ve noted here, Treasuries remain more focused on international markets than domestic economics in the short term. But, it is important to note that for the 2nd and 3rd quarters of 2014, the annualized increase of employment costs was +2.8%, the highest since 2008.

This is important from a Fed standpoint because it means the Fed is closer to achieving its goal of repairing the labor market. Stagnant wages, despite improvement in the unemployment rate, have been a thorn in the Fed’s side for years (it’s the “underutilization” the Fed keeps referencing).

If that trend is ending (and the ECI implies it is) then that is potentially “hawkish” down the road, because it means the Fed won’t have to keep rates this low to support the labor market that much longer.

Additionally, while all the world seems consumed by commodity-price-driven “dis-inflation,” wage inflation begets real inflation, and this number further refutes the “dis-inflation” argument. Point being, an uptick in wages is dis-inflation, regardless of what commodities are doing.

The “need to know” on this is that while it’s certainly not going to make the Fed more “hawkish” from a policy standpoint in the near term, wage inflation is bottoming. In the coming quarters (meaning into early ‘15), if wage inflation continues to increase, that may make the Fed get more hawkish than current expectations. This is an indicator we need to watch carefully in early ‘15, as the potential for a hawkish surprise from ECI is rising.

To learn more, sign up for a Free Trial on the right hand side of this page.