Bond Bubble

It’s the calm before the storm.

That’s what this market feels like to me right now, because the fact is that the events of the next six weeks have the potential to either 1) Ignite an acceleration of the recent rally or 2) Cause a sharp pullback.

While I admit these markets are downright dull at the moment, it’s important for advisors and investors not to get too complacent, because through the end of September we will get three key central bank decisions that will determine whether bond yields keep grinding lower, or finally reverse higher.

That’s going to be critically important for how stocks and bonds perform in Q4, and the potential is there for either a continued melt up (at which point advisors are going to want to be very long) or a potentially violent pullback in both stocks and bonds (at which point advisors are going to want to be very defensive).

The next six weeks will be an especially critical time if you are an advisor or investor who has underperformed markets so far in 2016 (and there are a lot of very good advisors who have underperformed this difficult market) as these events will present an opportunity to close that performance gap… if you know what’s happening and how to be positioned.

We are going to be very focused on making sure our paid subscribers know, immediately, what the implications are for each of these key events, and which sectors will benefit from those events, whether it’s banks, consumer staples, utilities, tech or inverse ETFs.

Look, it’s been a very tough year to beat lazy indexing, but we recognize the chance to make up ground over the coming weeks and into Q4 and we’re going to be focused on helping our advisor subscribers do just that by making sure they have the need to know analysis of all asset classes and global regions, not just US economics or the Fed.

We’re approaching the one-year anniversary of the August 2015 collapse in stocks, and while markets are higher (finally), so is volatility, as international events exert greater influence over the Fed, the US economy, and the US stock market.

We understand that in this market clients’ assets are, to a point, at the mercy of the BOJ, ECB, Italian banks, Chinese policy makers, etc., and that’s why, every day, we make sure our paid subscribers know the key trends in:

- Stocks

- Bonds

- Commodities

- Currencies

- Economic data

It’s only by providing that 360-degree coverage, every day, that advisors and investors can truly have an understanding of the risk and opportunities for their portfolios in this environment.

Earlier this week we outlined the three key central bank decisions that are coming in the next few weeks, and we’ve included an excerpt of that research for you below:

Three Key Events to Watch (Sevens Report Excerpt)

With yesterday’s FOMC minutes and today’s ECB minutes, stocks have now entered a five-week central bank gamut that will ultimately decide whether this market can grind higher

into Q4, or see a potentially violent reversal

of this low-rates-forever rally.

I say that because over the next several weeks, we will hear from

1) Fed Chair Yellen,

2) The ECB (again) and

3) (most importantly) the Bank of Japan.

Key Date #1: September 26. The Bank of Japan’s “General Assessment.” You’re probably not hearing a lot about this given the Olympics and political focus of the media, but this is easily the most important event for markets over the next six weeks.

The reason this is the most important date over the next six weeks is this:

A few weeks ago the BOJ again disappointed markets and announced they would be doing a “Comprehensive Assessment” of policy on Sept. 21. “Comprehensive Assessment” in this instance is central bank code for, “We’re going to change our strategy.”

The reason the BOJ needs to change its strategy is because their QE program has become so big that it’s dominating the Japanese Government Bond market, raising the risk of some sort of market dislocation, and it’s still not stimulating inflation or growth. So, put in plain English, their QE program isn’t working anymore, and making it bigger will only increase the chances that they form another massive bubble.

So, the BOJ needs to come up with a new strategy, and that’s what the “Comprehensive Assessment” is all about.

People think one of two things will happen at this Comprehensive Assessment:

Option 1: The BOJ will change the duration of JGBs it’s buying for QE from the current 7-12 years to something longer dated (beyond 12 years).

Option 2: (This is the potential negative outcome): The BOJ could “abandon” QE and instead just commit to keeping longer-term interest rates low by making targeted purchases on the long end of the yield curve. It’s the second option that scares markets, because while it’s still stimulus, it’s basically a tacit admission that QE has limits and has failed.

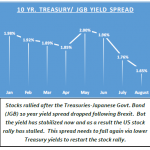

Why This Matters to US Investors: If the BOJ takes option 2, it could cause a spike in Japanese bond yields and could be the catalyst for a massive unwind of the global money flows into US Treasuries. That, in turn, will undermine the entire low-rate-forever rally in US stocks, as the most aggressive central bank in the world (the BOJ) waves a white flag. And, in this scenario, conservatively the S&P 500 could trade back to the initial breakout down in the upper 2000s (a 5% – 7% correction).

Key Date #2: September 8

The Next ECB Meeting. This ECB meeting is important because it’s been assumed (and priced in) to markets that the ECB would be more accommodative post Brexit. But, that hasn’t happened yet. If inflation and growth estimates released at this meeting are stronger than expected, then expected ECB policy will be more hawkish than thought.

Why This Matters to US Investors: If the ECB estimates are good and the ECB hawkish, it could cause a spike in German bond yields and could be the another catalyst for a massive unwind of the global money flows into US Treasuries. That, in turn, will undermine the entire low-rate-forever rally in US stocks, as European investors unwind Treasury long positions. And, in this scenario, conservatively the S&P 500 could trade back to the initial breakout down in the upper 2000s

(a 5% – 7% correction).

Key Date #3: August 26. Yellen’s Jackson Hole Address. Yellen won’t be “hawkish” in the commentary but the extreme complacency in Fed expectations does lend itself to a surprise. Despite recent hawkish commentary, there is still less than a 50% chance the Fed hikes rates in December! So, if Yellen implies a December rate hike (December, not September) in her remarks in late August that will cause a serious readjustment to the market’s Fed expectations.

Why This Matters to US Investors: If Yellen points to a December rate hike, that, combined with what could potentially happen in German bunds and Japanese bonds a few weeks later will undermine the entire low-rate-forever rally, as US, European and Japanese investors unwind Treasury long positions. And, in this scenario, conservatively the S&P 500 could trade back to the initial breakout down in the upper 2000’s (a 5% – 7% correction).

Markets Nearing Tipping Point: How these events turn out will create a pretty sustainable glide path for stocks to start Q4.

On one hand, if all of these events turn out benign, that will be bullish for stocks into year end and a very reasonable target will be 2240 in the S&P 500, and perhaps 2340. And, certain specific sectors should handily outperform into year end, offering smart advisors the opportunity to outperform.

On the other hand, if Yellen isn’t dovish and the ECB and BOJ are “hawkish,” that will undermine the entire reason for this 8%, post-Brexit rally, as it will cause bond yields to rise and stocks to fall. Avoiding that potential pullback will give advisors the chance to close a performance gap and redeploy capital at more favorable levels.

So, bottom line, getting these events right will be a big key to outperforming in Q4 and finishing the year with strong numbers, regardless of the environment.

We are going to make sure that our paid subscribers know what each of these events means for the broad market and, more importantly, what tactical sectors we think can outperform the market into year end. We are very focused on helping subscribers be properly positioned for the fourth quarter.

Click this link to begin your quarterly subscription today and make sure you’ve got an analyst team working to help you outperform into year-end.

What We’re Doing Now

We continue to slowly and methodically add tactical bank exposure, as that will be a sector that will handily outperform if bond yields do rise. Now, is that our biggest holding? No, of course not, but it’s a tactical long that has outperformed the broad markets

and will continue to outperform if yields drift gradually higher or any of the above events contain a “hawkish” surprise.

And, with bank stocks still generally down YTD and trading at historically low valuations, it’s not like we’re adding to some high valuation tech name or over-extended, “over-loved” sector.

From a risk/reward standpoint, if you’re looking to add a position or sector that still offers some relative value and the chance to significantly outperform if yields ever do rise, banks remain attractive from a risk/reward standpoint.

And, our preferred bank ETF does not have any European bank exposure, nor does it have any broad-based financial exposure to insurance companies or REITs – two sectors that are not trading at relatively cheap valuations.

Make sure you’ve got an analyst team that’s watching the macro horizon while at the same time focusing on sectors and tactical ideas that can help advisors and investors outperform.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Make More Money, Save Time, Have More Knowledge

Our job is to provide you the timely, need-to-know, critical information that will demonstrate to your clients:

1) That you are on top of the markets, and

2) That you are in control of their financial situation.

Actual subscribers to The Sevens Report have told me that discussing the information contained in the Report with prospective clients has helped them land accounts as big as $25 Million!

2015 was a volatile year, and things have gotten worse so far in 2016. Subscribe today and give yourself the market intelligence you need to help strengthen relationships with clients, and acquire new ones.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, so there’s simply no reason why you shouldn’t subscribe to The Sevens Report

right now.

If you want to make your business more successful, you have to possess unshakeable confidence in your knowledge, and helping you acquire that knowledge is what The Sevens Report is all about. Begin your subscription to The

Sevens Report right now by simply clicking the button below:

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom Essaye

Editor

The Sevens Report