A look at the Most Obvious Trend in the Bond Market

Currencies & Bonds

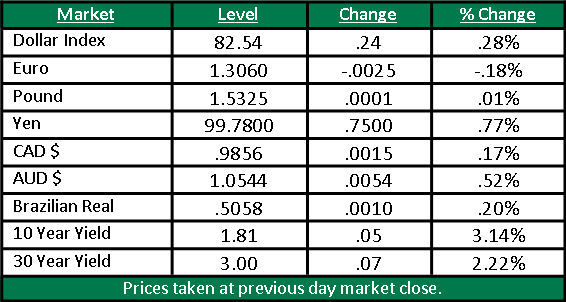

The “hawkish” Fed minutes were the main driver of trading in both Treasurys and the currency markets yesterday, as the thought of a dial-back of accommodation led to lower Treasury prices and a higher Dollar Index.

Treasurys declined sharply (30-year down 0.77%) and of note the decline accelerated throughout the afternoon despite a decently well-received 10-year Treasury auction that saw a bid to cover in line with recent averages despite the lower yield. But, Fed minutes trumped demand for Treasurys yesterday.

In currencies the Dollar Index rallied 0.3%, and was higher against the euro, pound and yen (which continues to inch closer to 100 yen/dollar).

Looking at the commodity currencies, the Aussie dollar continues its rally, rising to two-month highs in reaction to the stronger Chinese import data (that’s positive for Australian raw material exports).

Steepening Might Be the Most Obviously Trend in the Bond Market

Of note in the bond market yesterday was an article in the WSJ (link here) that focused on the fact that Bill Gross was bullish on the 10-year Treasury, an opinion based solely on the fact that “In this environment, and ever since 2008, an investor needs to buy what central banks buy before (central banks) buy them…..In this case, since its JGB’s, an investor needs to buy what Japanese institutions will buy.”

That logic, I believe, is sound, and this is coming from one of the bigger long-term Treasury bears out there. But, while I agree with Gross’s call on increased demand for 10-year or shorter-duration Treasurys, I still think the trend in the 30-year is lower, so this presents an interesting spread trade idea—Long TBF (I-Shares Short 20+ year Treasury) and also long IEF (I-Shares 7-10 year Treasury). So, you’re short the long end of the curve, and long the “belly” or medium part of the curve.

Or, put another way, if we have long dated bonds underperforming while shorter and medium-term bonds are well supported, we should see a significant steepening of the yield curve, and oddly enough there is an ETF for that too: STPP (IPath US Treasury Steepener ETN).

Now, this thing is totally trade by appointment and it’s an ETN, but it’s at pretty much all-time lows—so something to consider as another way to play the bond market where the BOJ is now a major influence.