Can Trump Fire Janet Yellen?

I was asked that question at a Christmas Party on Saturday night by a local real estate agent.

He’s not an active investor (he has an FA) but he does follow the markets, and he was nervous that Trump may fire Yellen because Trump said he thinks interest rates are too low (and rising interest rates are obviously not good for the real estate business).

Before telling my friend that Trump can’t fire Yellen, I asked him if he asked his FA the same question (I try not to directly contradict peoples’ advisors unless they are just outright wrong).

He said he did, but the FA gave this vague answer and dismissed the question. My friend got the distinct idea that the FA didn’t know the answer.

Now, that’s not a knock on the advisor.

In today’s ultra-competitive money management industry, advisors simply don’t have the time to spend doing the research needed to understand the Fed and the implications to all assets.

That’s why we make sure we do the work for them and deliver our daily research note to them at 7 AM every morning and keep it readable in 7 minutes, so they can spend their time on the things they are compensated for:

- Building client relationships,

- Increasing AUM, and

- Closing prospects.

To that point, I doubt this advisor’s firm provided her the direct explanation as to why the President can’t fire the Fed Chair, and I also doubt her brokerage firm provided much research on the Fed outlook for 2017 (beyond recapping last week’s FOMC Meeting).

But, as our focus turns towards 2017, there is the potential for even more Fed related market volatility as one of the biggest unknowns that has the potential to shake markets and the economy is the relationship between Fed Chair Yellen and President-elect Trump.

For the first time in my memory, we could be looking at a publicly adversarial relationship between the President and the Fed chair, and no one knows what that means for markets.

Since last Wednesday (the FOMC Meeting), we’ve been the Fed “expert” for our paid subscribers, and given them the talking points they need to 1) Explain why the Fed is causing bond yields to surge even higher and 2) Demonstrate they understand what more rate hikes in 2017 means for all client holdings: Stocks, Bonds, Currencies, Commodities.

At parties and events this past weekend, our paid subscribers had the talking points they needed to be able to turn my friend’s question into an opportunity to get a new client!

That’s what we do for paid subscribers every trading day at 7 AM, and it’s why we believe we’re the best value in the independent research space.

It’s important that everyone understands the context of the Trump/Yellen relationship, because that helps to look past the media hype and bluster to accurately assess what the changes in the Yellen/Trump relationship mean for markets. We’ve included an excerpt of that research as a courtesy.

Yellen vs. Trump

Potential differences between the two have been apparent for months, as Trump criticized the Fed on the campaign trail in two specific ways. First, he said the Fed has kept rates too low for too long, and has created multiple bubbles to prop the economy up.

Second, he said the Fed kept rates ultra-low to support the economy and get Clinton elected.

Since he won the election, Trump has stayed quiet on the Fed, although there were a lot of us watching Twitter following Wednesday’s FOMC meeting to see whether Trump would respond to what some interpreted as criticism by Yellen towards Trump/Republican fiscal policy.

We want to explore those comments and explain 1) Why they were hawkish and 2) What they mean for the Yellen/Trump relationship going forward.

Yellen’s Hawkish Point #1: It’s too Late For Fiscal Stimulus

Yellen was very explicit in the FOMC press conference in saying that large-scale fiscal stimulus was not needed now that the economy is basically at full employment, as it would risk igniting an acceleration in inflation (she is basically saying that fiscal stimulus now would do more harm than good, a direct contradiction to what the new administration is saying).

To understand her reasoning, imagine we’re trying to keep a fire going that’s almost gone out (the economy post 2008). To get the fire roaring again, we need kindling and wood (0% interest rates & QE) and a match (fiscal stimulus).

But, we don’t have any matches (there’s been no fiscal stimulus since ’08, and if anything, over regulation has inhibited growth). To keep the fire alive we keep heaping kindling (QE) and wood (0% rates) on top. And that partially works, and the fire doesn’t go out… but it doesn’t really grow, either (2% GDP growth since ’08).

Now we are left with a small fire, but a tower of wood and kindling above it that hasn’t caught on fire yet.

Then, after years of this we begin to see the fruits of our labor start to pay off as the lower logs are finally catching fire (full employment and an uptick in growth in 2016). Now we’ve got a fire that’s starting to grow, but we’ve got way too much wood and kindling on top of it, so we begin to remove the wood to make sure the fire doesn’t burn out of control (removing wood is equivalent to rate hikes).

Then, all of a sudden, someone comes along with a flame thrower (large-scale fiscal stimulus) and the risk is if they hit our tower of wood with this flame thrower before we can remove some of the logs, we’ll have an out of control inferno (surging inflation).

That’s basically the reasoning behind Yellen saying the economy doesn’t need large-scale fiscal stimulus right now (we needed it several years ago, before the theoretical tower of logs got too big). Now, I’m not saying I necessarily agree with that logic, nor am I endorsing it, but that is why she said what she did.

The reason this is a potential problem with Trump is because if Yellen stays on this message, then she is basically contradicting the administration and saying it’s doing the wrong thing economically.

And we all know how publicly criticizing Trump has gone over during the last 18 months—he yelled at the Pope, so I doubt Yellen is off limits!

Point being, there is the potential here for a very public disagreement, and that’s not good for investor sentiment or the markets.

Hawkish Point #2: The Fed Isn’t Trying to Overheat the Economy

As we stated last week, Yellen’s tone in this press conference was oddly defensive, and we can reasonably conclude it was in response to criticism of the Fed’s policies during the campaign season.

Specifically, Yellen very pointedly said the Fed was not trying to run the economy “hot,” i.e. keep rates lower than they should be solely to generate strong growth while ignoring the potential negative effects of inflation.

That comment was her rebuking Trump’s assertions that the Fed has 1) Kept rates too low to prop the economy up via the creation of asset bubbles, or 2) Kept rates too low to support growth so that Clinton could get elected. Again, this was surprisingly pointed, and the takeaway is clear. Yellen is aware of Trump’s criticisms, and apparently isn’t going to take them without response (although obviously never directly).

Bottom Line

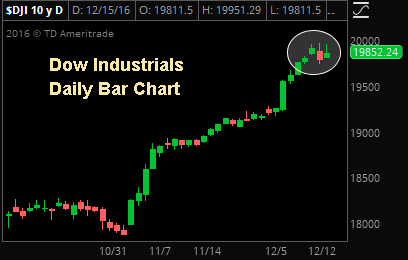

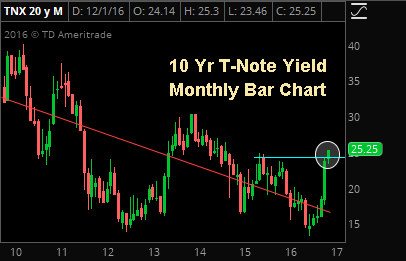

Quite simply, I (and no one I’ve spoken to) remembers a time when a public spat between the president and the Fed chair was this likely to occur. That will have implications across assets: stocks, bonds, currencies (especially the dollar) and commodities (esp. gold and oil). And, this dynamic leaves us with some strange questions to ponder as we enter 2017:

-

Will Trump accuse the Fed of political motivation if they continue to hike rates, and if that hurts growth?

-

If the Fed hikes faster following fiscal stimulus, will Trump see it as undermining his economic plan, and will he then launch a Twitter attack?

-

Will Trump mock or belittle Yellen publicly?

Shocking as it may sound, these all are real questions that will likely be answered early in 2017, and we need to understand the implications of those answers if we’re to start 2017 off on the right foot.

Again, all this matters for one specific reason: Interest Rates.

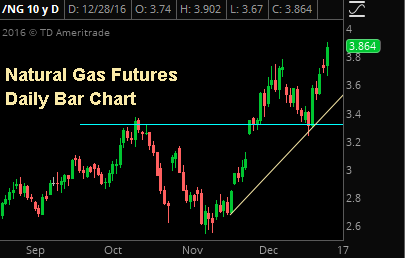

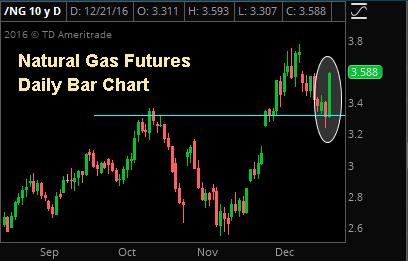

So far, stocks have weathered a huge spike in interest rates because markets expect economic growth to accelerate. But, rates keep rising at this pace, and the 10-year yield moves to and through 3% in Q1 2017, then that will have the potential to cause a potentially nasty pullback in stocks!

So, as we start 2017, make sure you’ve got an analyst team working for you who is focused on: Stocks, Bonds, the Dollar, Gold, Oil and Economic Data, because there will be volatility in 2017 (and potentially a lot).

We make sure our paid subscribers have the daily market intelligence and talking points across assets, so that they are never blindsided by a client question, and can turn any conversation into an opportunity to get a client.

And, we do it all just $195 per quarter ($65/month). It’s why we confidently believe we offer the best value in the independent research space.

I am so confident in the value our daily macro report provides that I’m continuing to extend a special offer to new subscribers of our full, daily report that we call our “2 week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

To start your quarterly subscription, and see for yourself how The Sevens Report can help you grow your business, click here.

Value Add Research That Can Help You Finish 2016 Strong and Start 2017 on the Right Foot!

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription now by clicking the button below to get redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65 dollars. To sign up for an annual subscription, simply click here.

Best,

Tom

Tom Essaye,

Editor of The Sevens Report