Dow Theory About to Get Bearish

Dow Theory is widely looked at as the first “technical strategy” for reading market trends and whether stocks are in a bull or bear market cycle. The strategy uses both the Dow Industrials Index and the Dow Transports Index in harmony do decipher the current market trends simply based off “highs” and “lows.”

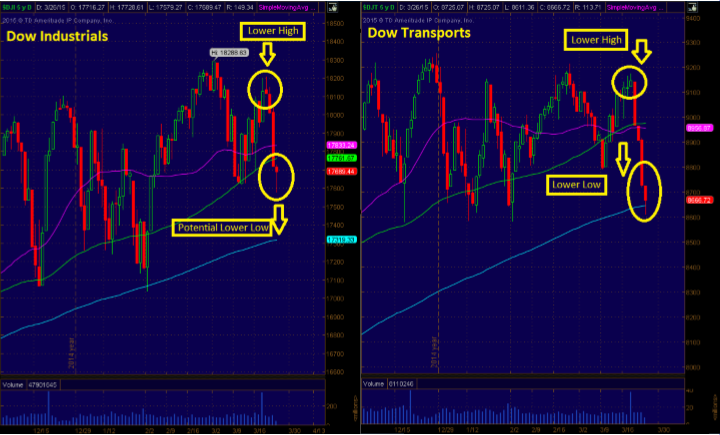

Long story short, “higher highs” and “higher lows” in the two indexes indicate stocks are in a bull market while “lower lows” paired with “lower highs” indicate a bear market.

Generally, the strategy is most accurate when applied to weekly or monthly time frame charts, however, the earliest indications obviously show up on the daily time frame. So, bottom line, keep a close eye on 17,635 in the Dow industrials, as a violation of that level on a closing basis would suggest the markets are entering a bear cycle, at least on the lower time frame, daily chart.