Oil Plunge

/in Investing/by Tyler RicheyWTI crude oil futures plunged well over 3% yesterday as the steady trend of climbing US oil production continues to weigh on the fundamental backdrop of the market.

Tom Essaye on “The Bell” Podcast with Kenneth Polcari and Adam Johnson

/in Investing/by Tom EssayeI was a guest on Adam Johnson’s podcast “The Bell” last week. We talk about the reality of tax reform, tax trade, geopolitics, and the bond market, straight from the NYSE Floor. We were also joined by Kenneth Polcari, Director, O’Neil Securities, director of NYSE Floor. Get a free two-week trial of Tom Essaye’s Sevens Report—everything you […]

Are British Elections a Bullish Gamechanger for the Pound? April 19, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. The pound was the big mover on Tuesday as it surged 2.2% following PM May’s call for elections in June. (As a bit of background, May calling for snap elections […]

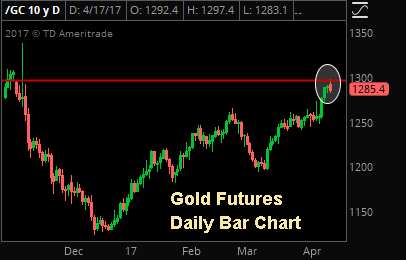

Gold Futures Pull Back

/in Investing/by Tyler RicheyGold futures rallied into resistance/our initial upside target just shy of $1300 yesterday before risk-on money flows spurred a reversal as fear bids unwound.

Last Week and This Week in Economics, April 17, 2017

/in Investing/by Tom EssayeLast Week in Economics – 4.10.17 The two important economic numbers came out Friday when markets were closed, so they didn’t receive much attention, although they should have. Both numbers (CPI and Retail Sales) further eroded the reflation trade thesis and will increase worries the economy is losing momentum. Starting with retail sales, the headline […]

Did Trump Just Kill The Reflation Trade? April 13, 2017

/in Investing/by Tom EssayeDid Trump Just Kill The Reflation Trade? An excerpt from today’s Sevens Report. President Trump, in an interview with the WSJ yesterday, appeared to change his policy on the Fed and interest rates. Specifically, Trump said he thought the dollar was getting too strong, that he favored a low interest rate policy, and he was […]

Earnings and economic growth are still solid

/in Investing, Reports/by Customer Service“Earnings and economic growth (the two most important foundational forces for stocks) are still solid,” the analysts wrote.