Why the Phillips Curve Matters to You, August 8, 2017

The Sevens Report is everything you need to know about the markets in your inbox by 7am, in 7 minutes or less. Start your free two-week trial today and see what a difference the Sevens Report can make.

Pushing unemployment lower should, eventually, cause inflation—unless this entire theory (upon which most of monetary policy is based) is incorrect.

The Phillips curve is a term you’re likely seeing and hearing more recently than at any time previously in your career (regardless of how long it is). The reason the Phillips curve is being discussed so much is simple: There’s a growing school of thought that thinks the Phillips curve is broken, and if that’s the case, then the Fed and other central banks may be largely powerless to spur inflation (which is a potential negative for the broad markets).

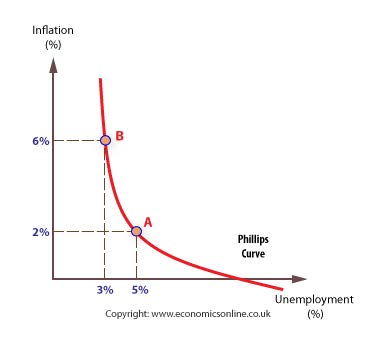

Before we get into this issue, though, first lets get a bit of background on the Phillips curve. Basically, the Phillips curve is just a graph of this simple idea: Low unemployment creates higher inflation.

From a commonsense standpoint, it is logical. Less available workers and robust business activity (so low supply and high demand for workers) will cause salaries (the “price” of a worker) to rise, and that in turn will flow through to the entire economy and spur price inflation.

So, put simply, the Phillips curve says low unemployment will spur inflation. And, this idea has been the cornerstone of Fed policy for decades and largely explains the Fed’s strategy post financial crisis.

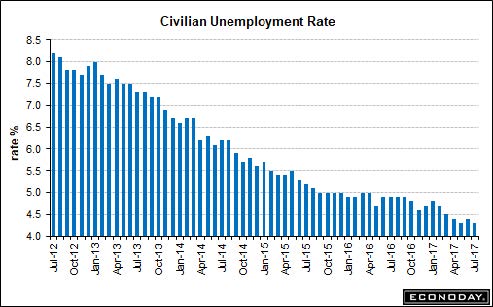

Plunging unemployment: At some point, this must create inflation, or at least that’s what Yellen believes.

But, there’s a small problem: It doesn’t appear to be working in today’s economy, as historically low unemployment is failing to spur inflation.

Now, this may seem like a theoretical, academic conversation, but it has real, near-term market consequences.

For instance, the entire mid-July rally in stocks came because the Fed began to note low inflation more than low unemployment.

That caused the decline in Treasury yields and exacerbated the drop in the dollar—and that helped spur a rally in stocks.

However, that may have changed with Friday’s jobs report. The unemployment rate hit 4.3%, matching a fresh low for this expansion (i.e. since the financial crisis). And, unemployment that low will get the Fed’s attention (at least Yellen’s attention) because while there is a debate about the Phillips curve still being accurate, the bottom line is that the Fed still follows it. At some point, if unemployment continues to drop, the Fed will have to continue with rate increases regardless of what’s happening with inflation.

And, that could have an important impact on returns and performance.

Here’s why: If unemployment grinds towards 4% or below, the Fed will have to get hawkish or either 1) Abandon decades of monetary policy that has largely worked, or 2) Risk a significant rise in inflation down the road (according to the Phillips curve) that would require a sharp, painful increase in interest rates—a move that almost certainly would put the US economy into recession.

The practical investment takeaways are this: (withheld for subscribers of the 7sReport—sign up for your free two-week trial to unlock).