WHY STOCKS DROPPED YESTERDAY

Yesterday’s dip in stocks was not because of an EpiPen, regardless of what the financial media said.

Yes, Hilary Clinton’s EpiPen comments did remind everyone of the healthcare induced pullback in 2015, but this time that’s largely a political distraction.

By far the most important thing that happened yesterday was that we learned 8 of 12 Regional Federal Reserve Bank Presidents requested a Discount Rate hike in July.

That’s potentially very important, because it means the chances of a rate hike in 2016 are higher than previously thought—and that is a threat to this market rally.

That’s the real reason stocks dropped yesterday, not some EpiPen political drama.

I included that analysis in the full, paid edition of The Sevens Report

this morning (which was delivered to subscribers at 7 a.m.), and I got some great feedback.

One subscriber, a wealth manager with ML, called and told me that he reads three things every morning: Gartman, The Sevens Report, and some of ML’s research.

He said Gartman had great information, but it was long and he really doesn’t need to know about pricing trends in cotton or the inner workings of Japanese politics.

The ML research was comprehensive, he said, but it was typical “Ivory Tower” stuff that was full of jargon and often tough to discern a clear, concrete takeaway.

He went on to say he subscribes to The Sevens Report

because every day it tells him, in plain English, what’s important in all asset classes: Stocks, Bonds, Commodities, Currencies, Bonds, and Economics.

No jargon, no obscure facts, just the information you need to know, in plain English, every day at 7 a.m.

And, he added that it didn’t hurt that the cost of The Sevens Report

was about 1/10th that of the Gartman Letter!

The truth is, this is a very difficult market, in part because there are unending distractions that take advisors and investors away from the key forces driving all asset classes right now: Global bond yields.

That’s why we consistently bring our subscribers (and you via these free excerpts) back to global bond yields, because they will decide whether stocks break out and extend the rally or break down and suffer a nasty pullback.

That’s why yesterday the most important piece of information was the revelation that at the July FOMC Meeting, for the first time in 2016, a majority of Regional Fed Bank Presidents called for a discount rate hike.

That’s a potential problem for stocks for two reasons:

- First, recent history implies a majority of Regional Fed Bank Presidents calling for a discount rate hike is a precursor to a Fed Funds rate hike, and

- Second, the market is still largely ignoring that fact as there is still just a 30% chance of a hike in September and a 50% chance of a hike in December.

Both of those numbers are too low, and both represent a potential risk to this stock market rally.

Understanding the outlook for US and global interest rates is the key to successfully navigating the markets for the rest of 2016, and we’ve included an excerpt of recent rate research as a courtesy.

Demand for a (Discount) Rate Hike Grows (Sevens Report Excerpt)

Easily the most important thing that’s happened so far this week is that a Fed document was released Tuesday that revealed for the first time in 2016, a majority of the Fed’s Regional Bank Presidents requested a reserve rate hike in July.

History tells us that implies that a majority of FOMC officials think the time for a Fed funds rate hike is sooner than later (like in the next month or two). For reference, the last time eight Regional Fed Bank Presidents requested a reserve rate hike was September and October of last year, and the Fed hiked in December.

But the important takeaway for any stock and bond holder is this:

The Fed may indeed be closer to a rate hike than the market expects.

And, that’s starting to be reflected in Fed Fund Futures as they have risen over the past week.

-

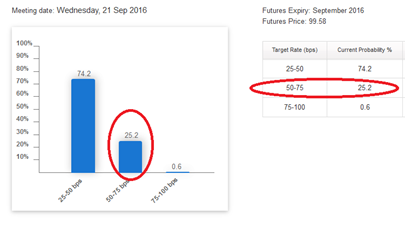

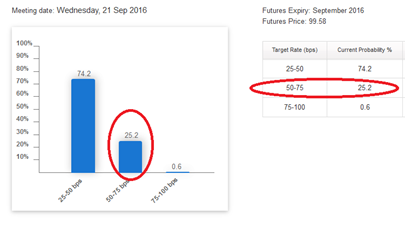

Last week, Fed Fund Futures showed just a 20% chance of a September rate hike.

-

Now, Fund Funds Futures reflect a 30% chance of a September rate hike.

-

Last week, Fed Fund Futures showed just a 40% chance of a December rate hike.

-

Now Fed Funds Futures reflect a greater than 50% chance of a December rate hike.

And, despite that, the S&P 500 is less than 1% off the recent highs.

That should be a concern, because the idea of forever-low global rates and no 2016 Fed rate hikes spurred a 7% S&P 500 rally in July, and if that proves to be untrue, then there’s a risk of a pullback.

Bottom line, there is mounting evidence that global and US interest rates may not stay as low as the stock market has currently priced in, and that is a risk to the entire July/August rally. Again, we won’t know the outlook for rates until the end of September. But the bottom line is that markets are very, very complacent with regard to any future rate hikes, and there is growing evidence that a rate hike is in the works.

The Next Six Weeks Will Be Critical for this Rally

For now, this remains a market largely stuck in neutral at the moment and in need of resolution on several key upcoming events before it can break meaningfully past 2200 in the S&P 500, given current valuations.

Specifically, the overhang of global rate uncertainty needs to be resolved before stocks can resume the forever-low-rates rally and extend multiples and valuations beyond current levels.

And, that process will begin tomorrow with Yellen’s Jackson Hole speech.

Generally, it’s expected that Yellen will be (as usual) dovish in her comments tomorrow, and if so, that could provide a short term boost for stocks. But, that’s not going to cause a real breakout in the markets

because what happens to US interest rates is as much a function of global events as it is Fed policy.

The risk tomorrow is that Yellen offers a “hawkish” surprise for markets, and that surprise combines with recent hawkish Fed rhetoric to cause a low volume, potentially sharp decline in stocks.

In tomorrow’s full, subscriber-only edition of the Report, we’re going to detail:

-

What to Expect from Yellen’s Comments

-

What specific comments or phrases will make her speech more “dovish” than expectations, and therefore short-term positive for stocks.

-

What specific comments will make her speech more “hawkish” than expectations, and thus increase the risk of a pullback.

-

And what specific policy will frankly “spook” markets and cause a decline.

-

And, most importantly, what sectors and ETFs will outperform regardless of the speech.

Paid subscribers to The Sevens Report will have this information at 7 a.m. tomorrow, in plain English and it’ll take them only a few minutes to read it, so they will be prepared to quickly and confidently answer any client questions about the Fed, and propose tactical ideas for how to potentially profit from a “dovish” Fed or protect portfolios from a “hawkish” Fed.

We will give our advisor and investor subscribers the plain English talking points to help them turn any Fed or central bank based volatility into an opportunity to demonstrate their knowledge of markets and impress current clients and prospects.

And, we are going to provide that same level of analysis for the remaining 5 key events that are coming in September, events that will decide whether this rally extends into the fourth quarter

- The ECB Meeting September 8th: Will the ECB hint at more stimulus (bullish) or not (bearish)?

- The Fed Meeting September 21st: Will the Fed hike rates (very bearish), hint at hiking rates in December (bearish) or stay ultra-dovish (bullish)?

- The Bank of Japan Meeting September 21st: Will the BOJ adopt “Helicopter Money Light” (bullish) or just do another inconsequential easing like in July (bearish).

- First Presidential Debate September 26th: Will Trump get back into the race (bearish short term – and this is not a political opinion) or will Clinton maintain a comfortable lead (not bearish).

- International Energy Forum September 26th: Will OPEC and Non-OPEC members agree on a global production but (bullish oil) or not (very bearish oil).

If all we do is help you navigate the month of September correctly and help you get properly positioned in client accounts for the fourth quarter, we will have more than covered our subscription costs.

If you do not have a morning report that is going to give you the plain English, practical analysis that will help you navigate the coming six weeks, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report

today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Grow Your Business in 2016

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report