This is an excerpt from today’s Sevens Report. To get your free 2-week trial, sign up now!

The Practical Takeaway from Low Volatility

One of the bigger conundrums right now is that volatility in the stock market is plumbing multi-year lows despite the presence of multiple major and binary events that will resolve themselves positively or negatively in the coming months.

Some examples (just to name a few): When/if we will get corporate tax reform? Will the US institute tariffs? Will interest rates continue to move higher? Is inflation finally back?

Each of these events could easily cause a pullback in stocks of at least 10%, yet investors seem unimpressed. Case in point, the VIX recently hit 9.97, which is a multi-year low.

Now, the obvious question is… “Why is implied volatility so low?”

First, implied volatility is low because the macro-economic backdrop has been supportive, and stocks have relentlessly gone straight up since November. This has been the longest stretch without a 1% decline in decades.

However, there is a second reason.

The lack of volatility has invited investors and funds to sell options (specifically puts) and collect premium. Given the lack of volatility, that’s been a profitable strategy, and it has invited more competition.

So, more investors selling options (i.e. selling volatility and collecting premium) pushes the price down, and that’s why implied option volatility (which is what the VIX is based on) has dropped extra low.

Normally, this would catch my attention, but a conversation I had with a friend in the insurance business made me both intrigued and concerned that this inherent “complacency” is prevalent throughout the economy. Here’s why.

I’ve almost never been an advocate of buying puts… yet buying puts to preserve market performance may not be a bad idea.

He said in his entire career, commercial and property insurance rates have never been lower than they are now.

And, if you think about it, I guess that makes sense.

I started my conversation with him because I asked my friend if my property insurance would go up because of Hurricane Matthew last year, and he said, “No way.”

He went on to tell me that the insurance companies are so flush with cash, they are just dying to write contracts to take in premium, and with so many competitors out there, it’s caused the price of insurance to drop sharply.

Empirically, that makes sense. With bond yields so low, insurance companies need to generate income and writing insurance over the past several years has been profitable (broadly speaking, we haven’t had any major disasters for the non-health insurance business).

But at this point, my friend remarked that it’s getting a bit ridiculous, as insurance companies are taking on a lot of exposure just to collect a little bit in premium (at least according to his experience).

Practical Takeaways

First, don’t assume that a low VIX means a drop in the stock market is looming. Implied volatility can’t get much lower, but it can stay down here for a while.

Volatility stayed around these levels for about two years in the ’93-’95 period, and again in the ’05-’07 period. Point being, low VIX is not a reason to expect a correction.

Second, insurance in the market (i.e. puts) is cheap, so we should consider buying insurance (i.e. buying puts).

As I said in Monday’s report, I’m almost never been an advocate of buying puts because I hate buying insurance.

Yet given we could easily see an air pocket open up in this market if corporate tax reform dies, or the Fed hikes rates in March, buying puts to preserve performance may not be a bad idea.

For less-experienced options investors, just buying near-the-money puts here might make sense.

For more experienced options investors, buying an at-the-money put and selling an out-of-the-money put may be attractive.

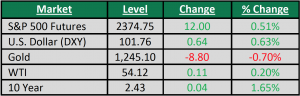

Here’s my logic. We think there’s strong support for the market around 2275, so as long as fundamentals are generally “ok,” we’d be ok buying the S&P 500 at that level.

So, we could sell 2275 puts (meaning we’d get put the stock at that level) and then use those proceeds to reduce the cost of an at the money put, say at 2370. That way, we’ve insured ourselves against any 5% or less drop in stocks, and also have the opportunity to buy the mar-ket cheaper at a level we’re comfortable with.

Third, actual insurance appears cheap, so I’m re-pricing life insurance and other insurance to try and lock in low prices.

Finally, generally, the idea that low yields and a chase for income is pushing both investors and insurance companies to increase exposure in exchange for reduced compensation is making my blood pressure go up.

As we’ve all seen, this can last for a long time, so it doesn’t mean a calamity is around the corner. Still, we all know that’s the kind of anecdotal behavior that leads to nasty consequences. Here’s to hoping it’s different this time.

For a monthly cost of less than one client lunch, we firmly believe we offer the best value in the independent research space. Subscribe to your free 2-week trial of the Sevens Report now.