Market Update: Buy, Sell or Hold

Last night my wife and I went out to dinner with friends. Shortly after we sat down, the conversation shifted to work, and eventually to what I do each day at The Sevens Report.

When describing the value that The Sevens Report

provides to our paid subscribers, my wife’s friend said, “so you’re basically a navigator of markets” for financial professionals.

It’s really a great analogy, as our goal at The Sevens Report is to wake up each day and help our subscribers navigate these complex markets, and provide the best value in market analysis out there today.

I created this report because I know that most financial advisors and professionals are not glued to blinking screens from 9:00 – 4:00 each day.

They are discussing the financial goals of their clients and mapping a financial course to reach those goals. Most of their time is spent building and fostering relationships, not analyzing Fed commentary, studying the yield curve, or digging through an oil inventory report.

The most successful advisors use tools like The Sevens Report

to stay ahead of the markets (stocks, bonds, currencies and commodities) and to make sure their clients are positioned to both outperform while also being protected from any financial “storm” that may blow up.

Specifically, we take complex macro-economic concepts (like ECB QE, Chinese economic policies, implication of rising interest rates, GDP, FOMC Statements, etc.) and tell you:

1) What you need to know

2) What will move markets, and

3) What will make those events positive or negative for stocks and other asset classes.

Every day at 7 a.m. we deliver this information, so you can show your clients you’re on top of the markets with a plan to outperform, regardless of the environment.

Stocks saw their first decent pullback in weeks Tuesday as an initial spike higher in Treasury yields following disappointment over underwhelming Japanese fiscal stimulus weighed on stocks.

And, with the Bank of England decision looming tomorrow and an important jobs report beyond that, the chances of rates moving higher are rising, and that’s a potential risk to stocks.

As a courtesy we have included analysis on yesterday’s selloff for you today:

Bottom Line—The Danger of Expectations

Yesterday’s surprise dip in stocks isn’t changing the outlook for markets, and including yesterday’s dip we can chalk this recent price action up to consolidation of the recent rally. In fact, part of the reason yesterday’s selloff caught people by surprise was because the market’s gone straight up for some five consecutive weeks.

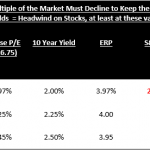

Beyond the short term, though, I do believe yesterday’s reaction validates what we’ve been saying about this rally since it started after Brexit—namely that it is founded on extreme dovish expectations for central banks, and extremely low expectations for interest rates well into the future (like years in to the future). Given that extreme expectation, markets are at a constant risk of a reset.

To that point, it’s important to understand that over the past few days Japanese authorities have eased policy further.

-

First, the BOJ increased its purchases of ETFs.

-

Second, the Abe administration added 7 trillion yen of new government spending to stimulate the economy.

And, tomorrow the Bank of England will almost certainly cut rates (more stimulus).

But, the actions by the BOJ and only a rate cut by the BOE (meaning no more QE) will underwhelm markets because of the absurdity of expectations with regards to policy.

Literally the only thing that would have pleased markets recently is if The Bank of Japan and Abe administration would have instituted “helicopter money” by:

1) Floating a 50-year bond Japanese government bond,

2) Having the Bank of Japan buy those bonds with printed money and

3) The Japanese government spend the BOJ’s money in the economy!

Ten years ago, even proposing the idea of doing something like that would have made you a candidate for an economist insane asylum!

Now, it’s expected, and the culprit is the central banks themselves who have trained markets that if currencies rise too much and stocks go down enough, they will do whatever it takes to placate the investor class.

That remains one of my biggest issues with this rally. It’s built on the idea of forever-low rates, but central banks have consistently disappointed since Brexit, and the BOE may do it again tomorrow.

This is a theoretical rant, but at some point this system will break.

Maybe we’ll be at S&P 500 2500 before it does, but this relentless appetite by markets for more and more stimulus isn’t healthy longer term, and this week’s price action has made me all the more concerned that unless we get back to some state of normalcy in monetary policy sometime soon, the fallout for all this will be extreme.

Making this rant practical, central banks have consistently underwhelmed markets since Brexit and it’s starting to take its toll as the rally has stalled.

If the Bank of England disappoints markets tomorrow, and Friday’s Jobs Report runs “Too Hot” that will cause a move higher in bond yields, and that could well signal an impending pullback.

Tomorrow’s edition of The Sevens Report will be sent to paid subscribers shortly after 7 a.m. so we can tell them the market implications of the Bank of England decision. And, it’ll include our “Jobs Report Preview” that will directly tell subscribers what specific levels of a jobs report will cause Treasury yields to rise, and stocks to drop.

Click this link to begin your quarterly subscription and make sure you have an analyst team committed to helping you navigate this still challenging market.

Use Market Volatility to Your Advantage

The Sevens Report isn’t just another research tip sheet that’s designed to tell you whether stocks are going to go up or down. Rather, it’s a tool we have created for the purpose of helping advisors:

- Attract more clients

- Increase assets under management

- Improve retention

In fact, The Sevens Report helped thousands of your colleagues and competitors at wirehouse firms and smaller RIAs be more efficient and more effective in finding and closing new clients since we launched in 2012, and we are doing it again in 2016.

We know this because last year, an advisor from Florida called to personally tell us that sharing The Sevens Report with one of his larger prospects helped him land the $25 million account!!!

He said the independent analysis provided talking points for him to discuss in the meeting, and it helped show his prospect that he wasn’t all about “touting the company line.”

Another FA at an independent firm told us that our analysis of the recent stock market sell-off saved his clients a substantial amount of money.

He wrote, “Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!”

These are the results our subscribers are achieving with The Sevens Report.

And, we know our product delivers because we have a nearly unprecedented retention rate of over 90%.

2016 has already been a volatile year, and with divergent central bank policies emerging around the globe, still-volatile oil prices, and important political events (Italian and US elections) looming, markets are going to stay volatile, so consider making a small investment in your business that can:

1) Save You An Hour Each Day

2) Help You Make Better Investment Returns

3) Increase Your Market Knowledge and Confidence When Talking with Prospects

Affluent clients want communication on the markets that is not “boiler plate” strategy updates from your broker dealer. They are expecting you to know what is happening in the markets and how it is affecting their portfolios, especially in this difficult environment.

We created The Sevens Report, so that advisors can make sure they have an independent analyst that communicates with them every day and quickly identifies for them the risks and opportunities for:

- Stocks

- Bonds

- Currencies

- Commodities, and

- Interprets what economic data means for the market.

Most of our subscribers are not actively trading clients’ accounts. However, they can demonstrate to their clients that they weren’t blindsided by the recent volatility

thanks to The Sevens Report.

That’s the kind of analysis that leads to More Clients and ultimately More AUM.

So, why not make an investment in yourself and your business in 2016? We are confident it will produce returns many times greater than the cost (which is less per month than one client lunch).

Because of the great response we have seen, I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2 week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report