Chart of the Day

“I’ve Got Your Six.”

You may have heard that saying – it’s a military term and it means, “I’m watching your back,” as the “six” refers to your “Six O’clock.”

Here at The Sevens Report, we often say that we’ve got our subscribers’ “six,” and that’s why in today’s paid edition of the Report we alerted them to a potentially very important event that occurred in the markets yesterday.

That event was the dollar breaking out above the post-Brexit peak and hitting a new, four-month high.

Why is that so important?

Because if the dollar keeps rising, it will cause this rally in stocks to stall.

The dollar hit new highs yesterday mainly because Jon Hilsenrath, the WSJ’s resident “Fed Mole,” wrote an article that said the Fed is still open to raising interest rates this year, perhaps as early as September.

And, that’s a problem because the market currently doesn’t expect a rate hike until mid-2017!

Of course, it’d be easy to miss this potential new risk to stocks if you’re just watching CNBC or reading the major financial media sites, because all they wanted to talk about yesterday was NFLX’s subscriber churn or the YHOO sale/debacle.

But those aren’t the things advisors really care about. If you’re like most advisors that subscribe to The Sevens Report, you’re not doing a lot of single stock research or single stock allocations.

Instead, you’re making general, longer-term allocations to sectors or assets, and you need to know:

- When a material pullback is coming, and

- When to get more defensive in client portfolios, because avoiding pullbacks is the secret to outperforming in a diversified portfolio.

We understand that – and thousands of financial advisors from virtually every firm on Wall Street subscribe to The Sevens Report, because we are constantly watching for risks—whether those risks come from a rising dollar, Brexit, a declining Chinese yuan, or Italian banks.

It’s not that we’re bearish – we own stocks in our retirement accounts and 529s – but one of our main responsibilities is to watch the risks, because we all know there’s more than enough perma-bull research out there.

So, while everyone is excited that stocks are again beating sandbagged earnings estimates, we’re focused on two major risks to this rally:

- Higher Interest Rates (That the market is too dovish with regard to the Fed).

- A Stronger Dollar (It’ll hurt corporate earnings in the coming quarters).

We keep a special focus on risks to the market because we know that sophisticated, ultra-high net worth clients want more than the standard, boiler plate “perma-bull” outlook on stocks.

Ultra-high net worth individuals know there are always risks in the market, and The Sevens Report provides independent talking points for advisors to use in those meetings to show prospects that they aren’t all about “touting the company line.”

And, our independent analysis yields results.

An FA at an independent firm told us that our analysis of a recent stock market selloffs saved his clients a substantial amount of money.

He wrote, “Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!”

These are the results our subscribers are achieving with The Sevens Report, the daily macro-economic research report that’s delivered to subscribers every day at 7 a.m., and that quickly identifies the risks and opportunities for:

- Stocks

- Bonds

- Currencies

- Commodities, and

- Interprets what economic data means for the market

Despite generally bullish sentiment, there remain legitimate risks to this rally, and we’ve included an excerpt of that research for you below as a courtesy:

Two Risks to This Rally

Risk 1: Interest Rates Go Up (even a little bit).

A surge higher in Treasury yields is now the biggest risk to US stocks near term.

-

Markets currently don’t have a rate hike priced in until the middle of 2017.

-

Fed Fund Futures have only a 13% chance of a rate hike in September, and just a 40% chance of a rate hike in December.

Frankly, that’s too dovish if the economic data stays decent.

And, given that the real reasons stocks have rallied is because investors are using the expectation of forever-low interest rates to justify higher than normal valuations, rising interest rates are a problem as they blow up the entire reason for the rally.

So, right now, the No.1 event that could derail this rally is a surge higher in yields, and that’s not an unreasonable expectation:

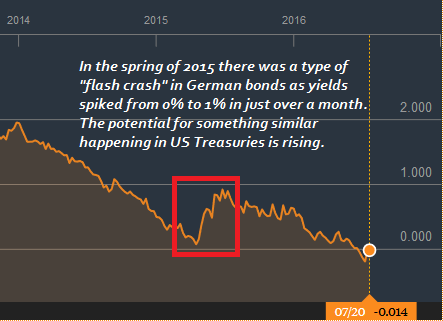

In the spring of 2015 German bund yields rocketed from basically 0% to 1% in a few weeks after market expectations became too dovish (causing stocks to drop).

Three years ago, then Fed Chairman Bernanke surprised a very dovish market by hinting QE could end, and it caused the Taper Tantrum of 2013, and Treasury yields spiked and stocks to plummeted over a four-week period.

To monitor this risk, we are watching specific levels in the 10-year Treasury yield (the specific resistance levels are provided only to paying subscribers) and if the 10-year yield breaks that resistance (it’s not far now) that will be a negative signal for stocks and our subscribers will know it.

Risk 2: A Stronger US Dollar

For the last two months we’ve told our paid subscribers that the bullish argument is based on a simple equation: A P/E multiple of 17, and a 2017 S&P 500 EPS of $130 means the S&P 500 could trade as high as 2200 (that’s 17 x $130).

That’s the simple equation that’s driving the S&P 500 relentlessly towards 2200.

But, a stronger dollar blows up that equation for two reasons:

-

A stronger US dollar will reduce overall earnings and create downward risk for that 2017 $130 EPS expectation, potentially making the market more expensive.

-

A stronger dollar will pressure oil and other commodities, reducing energy company earnings, and that will create downward risk for that $130 EPS expectation.

To monitor that risk, we are watching the dollar, and if it continues to rally and crosses key technical resistance levels (which we have provided for our paid subscribers) that will be a signal to begin getting more defensive, as the foundation behind this recent rally will start to crack.

What to Do Now

There remains a tremendous amount of noise in the markets today.

Yesterday, the “hawkish” Hilsenrath article caught many people by surprise and caused the mild dip in stocks. At the same time, however, Morgan Stanley produced a report that implied the Fed won’t hike this year… or next year.

Our job is to cut through that noise for our subscribers and stay focused on the real risks to this rally, so we can alert our paid subscribers early to when those risks become great enough to warrant a more defensive allocation.

They know that every day at 7 a.m. they will have one document that provides them the market analysis and macro talking points to “wow” clients and impress prospects.

Most importantly, they know that there will be an independent analyst watching the macro horizon and monitoring risks to their clients’ portfolios, so neither they nor their clients ever get blindsided.

And, we will alert our subscribers to any breakout that occurs in Treasury yields or the dollar and analyze the implications for the market in general, and for equity asset allocations.

If you do not have one research document that provides macro analysis as well as tactical investment idea generation every day at 7 a.m., please consider a subscription to The Sevens Report.

We firmly believe we offer the best value in the paid research space.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report

today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Increased Market Volatility Will Be an Opportunity for the Informed Advisor and Investor

We aren’t Market Bears, but we said consistently that things were going to be volatile in 2016 and we were right!

In 2016, the advisor who is able to confidently and directly tell their nervous clients what’s happening with the markets and why stocks are up or down, and what the outlook is beyond the near term (without having to call them back), will be able to retain more clients and close more prospects.

We view volatility as a prime opportunity to help our paying subscribers grow their books of business and outperform markets by making sure that every trading day they know:

1) What’s driving markets

2) What it means for all asset classes, and

3) What to do with client portfolios.

We monitor just about every market on the globe, break down complex topics, tell you what you need to know, and give you ETFs and single stocks that can both outperform the market and protect client portfolios.

All for $65/month with no long term commitment.

I’m not pointing this out because I’m implying we get everything right.

But we have gotten the market right so far in 2016, and it has helped our subscribers outperform their competition and strengthen their relationships with their clients – because we all know the recent volatility has resulted in some nervous client calls.

Our subscribers were able to confidently tell their clients 1) Why the market was selling off, 2) That they had a plan to hedge if things got materially worse and 3) That they were on top of the situation.

That’s our job. Each and every trading day.

And, we are good at it.

We watch all asset classes to generate clues and insight into the near-term direction of the markets, but our most important job is to remain vigilant to the next decline.

While we spend a lot of time trying to identify what’s really driving markets so our clients can be properly positioned, we also spend a lot of time identifying tactical, macro-based, fundamental opportunities that can help our clients outperform.

If you want research that comes with no long-term commitment, yet provides independent, value added, plain English analysis of complex macro topics, click the button below to begin your subscription today.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65 dollars. To sign up for an annual subscription, simply click here.

Best,

Tom

Tom Essaye,

Editor of The 7:00’s Report