10 Year Treasury: January 23, 2017

10 Year Treasury: The greenback ended a volatile week little changed as the Dollar Index dropped more than 1% last Tuesday after now-President Trump called it “too strong.” Then a hawkish tone from Yellen on Wednesday, and dovish comments from ECB President Draghi Thursday, helped reverse that initial decline. The Dollar Index ended the week down 0.30%.

The headline volatility around the dollar last week is likely a preview of what’s to come over the next year (it’s going to be a good one for currency brokers) because while the trend in the Dollar Index remains clearly higher, there will be bouts of sharp declines due to politics, economic data, etc. However, at its core, the rising dollar is an economic and interest-rate phenomenon, not a political one.

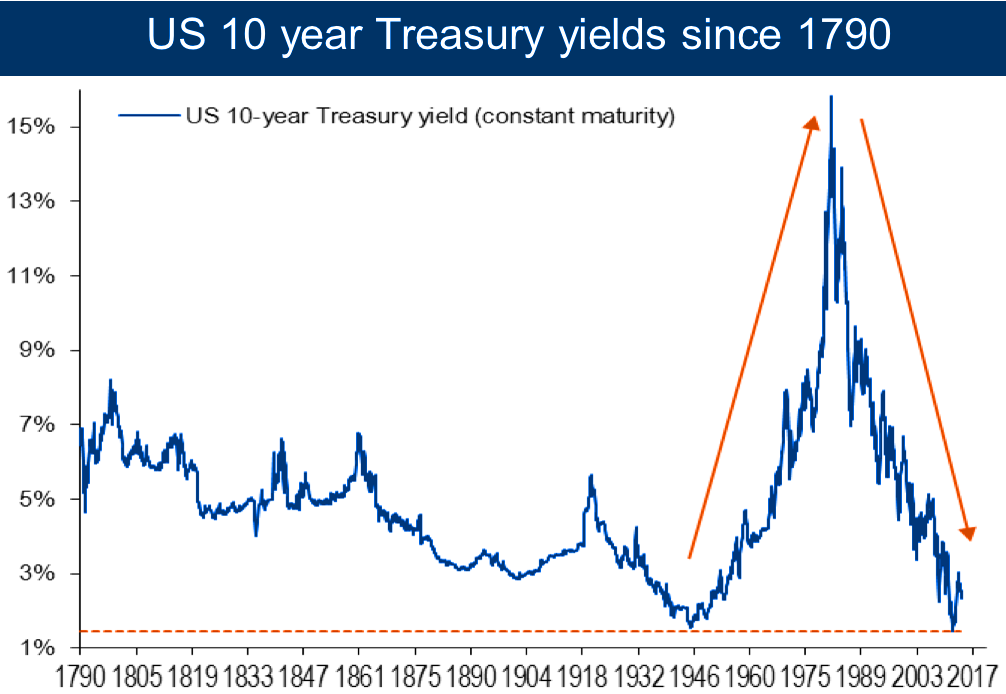

Turing to bonds, yields were sharply higher last week on a combination of firm inflation data (CPI, Prices Paid indices, Beige Book commentary) and Yellen’s hawkish tone from Wednesday. The 10-year Treasury yield rose 7 basis point while the 30-year yield rose 6 basis point, the first weekly rise since early December.

Going forward, depending on economic data, it looks like this counter-trend rally in a greater bond decline is coming to an end, and we are watching 2.60% in the 10-year yield specifically. If that level is broken, then we could see a potentially sharp acceleration in Treasury yields, and stocks will definitely start to notice if/when the 10 year approaches 3%. Economic data needs to continue to accelerate for stocks to weather that type of a rise in yields.

This Week

The key number to watch this week is the flash manufacturing PMI out tomorrow. As stated, that number needs to remain firm for general market psyche, because we’re likely to encounter at least temporary disappointment on the fiscal stimulus front in the next few weeks (as is typical in Washington).

Beyond the flash global PMIs, Durable Goods and Q1 GDP are the two next most important numbers. Durable goods will offer the latest insight into business spending, which needs to continue to accelerate. GDP won’t mean much from a market standpoint but the media will cover it, and anything north of 3% will be taken as a positive (although a number that high is unlikely). For all the optimism over future growth, right now the economy is still stuck in 2%ish annual growth mode, just like we’ve been for the last several years.

Finally, Existing Home Sales comes Tuesday, and as we mentioned last week, it’s critical to the economy that the housing recovery doesn’t get derailed by higher rates. Last week’s Housing Starts data was mixed, so focus will remain on the December data, as that was the first full month of consistently higher rates.

Bottom line, the key here is acceleration in the data. Better economic growth and hope of fiscal stimulus has powered stocks higher, but the latter will likely get delayed due to regular Washington shenanigans. To counter that, growth needs to continue to accelerate.