What’s the TINA Trade?

Do you know what the TINA trade is?

I ask that, because I’m pretty sure talking about the TINA trade would have just gotten me new clients, if I was a financial advisor.

I just finished giving a presentation on the economy and markets to a group of business executives. While most of the presentation was spent talking about the lackluster fundamental backdrop for the markets, I told them that the reason the stock market was making new highs seemingly every day was because of the TINA trade.

TINA stands for There Is No Alternative, and it’s an acronym to explain why capital is funneling into stocks despite uninspiring economic activity and declining earnings growth.

The TINA Trade: There Is No Alternative to Stocks!

The discussion of the TINA trade generated, by far, the most response and excitement from the crowd.

After my speech, many prominent doctors, lawyers and business owners came up to me to discuss the TINA trade, and I couldn’t help but think that if I was a financial advisor, I would have just gotten a lot of really hot leads, because all of these men and women were asking me… “What do we do?”

I know it’s a dull market right now, but sophisticated investors I speak with know that something here isn’t right, and that markets are still risky. Because of that they want to know their advisor knows the markets and is watching their backs—and that he is not just some salesman pushing the firm’s structured products or sponsored ETFs as the market goes whistling past the graveyard.

That’s why the TINA trade discussion got so much response, and again, if I were an advisor I’m pretty confident I’d be getting some new clients out of that breakfast.

We produce The Sevens Report

so that advisors always have the talking points they need to impress prospects and show clients they are not just touting the company line—and it’s that independent analysis our advisors reference during meetings that helps turn prospects into clients.

That’s why thousands of financial advisors and investors read the full, paid version of our daily research report, because it tells them everything they need to know about Stocks, Bonds, Commodities, Currencies and Economic Data.

We provide the succinct analysis that allows advisors to

1) Save an hour

of research time each day

2) Increase their knowledge

about the markets

3) Have the talking points

to impress prospects and reassure current clients.

And we do this all for a monthly cost of less than one client lunch.

That’s why we say we offer the best value in the paid research space, and our over 90% initial retention rate confirms it.

Stepping back, do we think this rally is heralding a new bull market in stocks?

No, we don’t.

The risks to this market are generally unchanged from three weeks ago, and we’re continuing to monitor those risks for our subscribers.

But clearly, the near-term trend is higher, and you learn quickly in this business you have to invest in the market you’ve got, and not the one you think you should have!

So, the key question remains whether investors need to abandon those defensive equity positions and rotate into higher-growth/higher-beta sectors like tech/consumer discretionary and basic materials.

That’s a pretty important question from a performance standpoint, because defensive sectors have outperformed cyclical sectors in 2016 – and if we are going to see a massive rotation back in to cyclicals, then advisors need to know that to maintain outperformance.

We discussed the potential for that rotation in a recent edition of The Sevens Report

and have included an excerpt for you here below.

Tactical Sector Update: Great Rotation or Not?

Post Brexit, one of the topics we’ve been very focused on covering was the possible “Great Rotation” by investors out of defensive, higher-yielding sectors (staples, REITs, utilities) and into more cyclical sectors (consumer discretionary, banks, tech), because if that rotation does occur, it could have a profound impact on whether an advisor can outperform into year end.

To that point, while the S&P 500 is up nicely this year (a little under 7.5% after yesterday’s close), being over-allocated to defensive sectors throughout 2016 has been a recipe for outperformance. Case in point, our “Defensive” broad allocation suggestion (which is 2/3 defensive sectors, 1/3 cyclical sectors) has outperformed the S&P 500 by nearly 2% year to date and has been less volatile.

But given the breakout in stocks post Brexit, and the prevalence of the TINA trade in stocks (TINA=There Is No Alternative), that defensive outperformance could easily reverse.

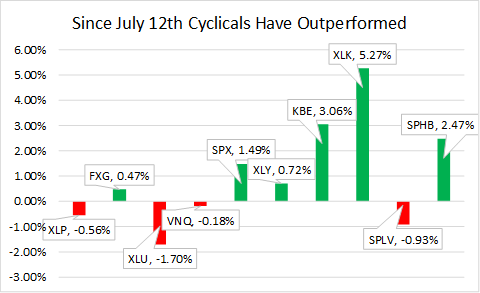

Over the past month, there are hints of that starting, and recently we’ve seen a slight rotation out of safety and into cyclicals (including yesterday). Since July 12, the S&P 500 is up about 1.5%, and more cyclical sectors are up anywhere from 0.7% (consumer discretionary, XLY) to 5.27% (tech, XLK). Conversely, traditional safety sectors are all down slightly (staples off less than 1%, utilities down less than 1%).

Looking more broadly, since July 12, SPHB (S&P 500 high beta ETF) is up 2.4% while SPLV (S&P 500 low beta ETF) is down 0.9% (although SPLV is still up 10.4% YTD while SPHB is up 7.5%, the gap is closing). So, with some evidence of this rotation, the question we are addressing is whether we should begin to sell some of our defensive sectors and re-allocate to more cyclicals sectors.

So far, the answer is “no,” and for three reasons:

1. Where would we go?

If you or your clients have owned staples and other defensive sectors for part or most of the year, it doesn’t make sense to sell them yet because no other sectors in the market offer a comparable yield and less volatility (remember, if you’ve owned them for a while the realized yield is higher than the current yield because you have a lower cost basis).

2. Economic growth isn’t breaking out.

Cyclicals generally outperform in a rising economic tide, but we’re stuck in stagnant water (and have been for years). Despite hopes, GDP is still looking to be on trend at an uninspiring 2%-ish growth for Q2 and Q3. That favors defensives.

3. The 10-year yield hasn’t broken out.

Think of the logic—the reason the stock market has rallied is because of the expectation of “forever-low” interest rates amidst slow/stagnant global growth. Well, beyond the short term, if rates are forever going lower, wouldn’t I want to hold my higher-yielding equities? It’s only when the 10-year Treasury yield breaks out to the upside that I would want to truly exit higher-yielding sectors and move into cyclicals.

Now, shorter-term underperformance is to be expected, and that’s why, several weeks ago we bought a regional bank ETF that we believed would help reduce any relative underperformance if we saw the start of a rotation out of safety and into cyclicals.

That decision has proved wise, because since then that ETF has rallied almost 5%, handily beating the S&P 500 and cushioning the relative underperformance of defensive sectors.

If you are heavy in defensive sectors, then I would advocate buying this regional bank ETF here because it will go up more than other sectors if rates start to rise.

Finally, we understand that getting this potential rotation right could be the difference between outperforming in 2016 and underperforming. So, we will continue to watch closely, and we will alert paid subscribers when, and if, we think it makes sense to exit defensives and move into cyclicals—including which specific ETFs we would allocate to with tactical funds to make sure you maintain outperformance.

These are the dog days of summer but this dull market isn’t going to last much longer, and volatility could make a big comeback starting in the next few weeks:

- Fed Chair Yellen’s speech on August 26th may reset interest rate expectations and cause a pullback in stocks.

- The US political election looks one-sided at the moment but polls always tighten into the election and the first debate is coming up (also in late September).

- In Italy, a key election is looming this fall and if it goes against expectations (like Brexit) it could spark another banking crisis in Europe.

- Chinese economic data last week was lackluster, and if we see a loss of momentum that will become a headwind on stocks.

- Markets are losing confidence in central banks, and if that gets worse through more ineffective policies this fall, that will cause volatility.

We’re committed to making sure subscribers to our full morning report have the independent analysis they need to navigate macro risks

while at the same time having the tactical idea generation that can help their clients outperform.

If your paid subscription research isn’t giving you talking points to discuss with clients, monitoring the macro horizon to keep you aware of risks, and providing tactical allocation suggestions and idea generation, then please consider a quarterly subscription to The Sevens Report.

If all we do is help you get one client, that will more than pay for the subscription!

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report

today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Grow Your Business Into Year-End

Our subscribers have told us how our focus on medium term, tactical opportunities and risks has helped them outperform for clients and grow their books of business.

We continue to get strong feedback that our report is: Providing value, Helping our clients outperform markets, and Helping them build their business:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65 dollars. To sign up for an annual subscription, simply click here.

Best,

Tom

Tom Essaye,

Editor

The Sevens Report