Could the Yield Curve Invert?

Yesterday, a subscriber called to tell me about a successful meeting he had with a client this week, in which the advisor explained:

- What the Equity Risk Premium was,

- Why it was driving stocks higher, and

- Why the 10-year yield is now a leading indicator for a potential correction in stocks.

The client asked him “How’d you Know That?”

because the advisor sends this client virtually all of compliance approved firm research materials, and they didn’t say anything about the Equity Risk Premium.

The advisor’s answer: “The Sevens Report.”

This advisor went on to tell the client that he uses

the daily publication as an independent research “check” on the firm-provided research to help formulate his overall investment strategy and make sure his clients are protected from macro risks.

Most importantly, the subscriber told me his client left the lunch happy and confident that his account was in capable hands.

So, what information did you have this week to impress clients?

The Sevens Report isn’t just another research tip sheet that’s designed to tell you whether stocks are going to go up or down. Rather, it’s a tool we have created for the purpose of helping advisors:

- Attract more clients

- Increase assets under management

- Improve retention

In fact, The Sevens Report helped thousands of your colleagues and competitors at wire house firms and smaller RIAs be more efficient and more effective in finding and closing new clients since we launched in 2012, and we did it again in 2016.

Affluent clients want communication on the markets that is not just a “boiler plate” strategy update from your broker dealer. They are expecting you to know what is happening in the markets and how it is affecting their portfolios, especially in this difficult environment.

We created The Sevens Report, so that advisors can make sure they have an independent analyst that communicates with them every day and quickly identifies for them the risks and opportunities for:

- Stocks

- Bonds

- Currencies

- Commodities, and

- Interprets what economic data means for the market.

Most of our subscribers are not actively trading clients’ accounts. However, they can demonstrate to their clients that they weren’t blindsided by the recent volatility

thanks to The Sevens Report.

That’s the kind of analysis that leads to More Clients and ultimately More AUM.

Easily the most important thing that’s happened this week has been that the Bank of England’s QE program basically “failed” on Tuesday, and we’ve included an excerpt of that research for you below:

Implications of a Failed GILT Purchase Program

Most advisors don’t follow global bond markets, but the most important thing that happened this week was in the British bond market and it’s important for your clients because:

-

It’s another sign that global central bank policies around the globe are becoming less and less effective (which is a problem for an equity rally based on central bank help), and

-

Further easing by the Bank of England or other central banks will have real world implications on US bonds, including potentially inverting the yield curve

(which is a historic warning sign for stocks).

What Happened: On Tuesday, the Bank of England became the latest central bank to have egg on its face when, on the second day of its newly expanded QE program, the bank was not able to buy its daily quota of long dated bonds. The BOE sent bids for 1.17 billion pounds worth of 15 year and longer GILTS (British Government Bonds), but it only received offers for 1.118B of GILTS, falling short by over 52 million pounds worth of debt.

Because of how screwed up the global bond markets have become, holders of long term GILTS were literally unwilling to sell to the BOE because they know that 1) There’s nowhere else in the market to generate a decent yield, and 2) These GILTS are just going to keep going up. This is a prime example of where economic theory unfortunately meets market reality.

Why It Matters:

Reason One: Eroding Central Bank Confidence is a Longer-Term Problem for Stocks.

Japan has been ground zero for this eroding confidence as the Bank of Japan, over the first eight months of 2016 has largely admitted that, practically speaking, it is out of bullets to stimulate the economy. And that any further material easing: 1) Can’t be effectively executed because of the size of various markets, or 2) Will cause more harm than good

(like when negative interest rates sent global stocks plunging last week).

Bigger picture, for those investors with larger time horizons, I feel like even lower yields and more and more easing is becoming a virtual pressure cooker, and as yields grind lower the cooker is starting to shake and screws and nuts are starting to fly off as the pressure gets too great.

Perhaps that’s a bit over the top, but there are anecdotal signs that this entire system is starting to show signs of serious stress, and with global bonds, stocks and real estate all at all-time high prices, I honestly fear for the global economy if this thing blows up. I hope I am wrong.

Reason 2: The Yield Curve Might Invert, Signaling a Looming Recession.

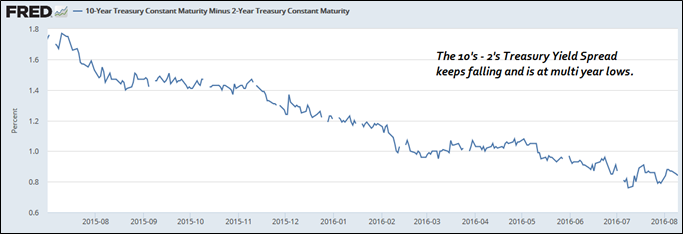

We’ve talked for weeks now about the compression of the 10’s -2’s Treasury spread, and that if the yield curve inverts, that’s historically a sign of impending recession—or in this market, something worse.

And, that fear has been elevated after the BOE this week.

That’s because while the BOE was unable to fill its quota of long-term debt, it easily bought more medium-term debt (GILTS that don’t yield as much).

That’s important for three reasons:

First, it’s created more downward pressure on 30 year Treasury yields. BOE QE makes the 30-year Treasury even more attractive because the yield of over 2% is much, much better than anything else out there right now. So, that will keep downward pressure on 30-year yields.

Second, it puts more downward pressure on 10-year Treasury yields. BOE QE will make the US 10 Year Treasuries even more attractive because the yield at 1.5% is much, much higher than anything comparable in the market, so that will keep pressure on the 10-year yield.

Third, it will not put pressure on 2-year Treasury yields. Finally, with economic data consistently coming in better than estimates (including last week’s jobs report), a Fed hike can’t be delayed any further than is currently expected.

So, the likely direction of the 2-year Treasury yield is flat to higher, unless economic data gets worse—and at that point we’ll be facing a recession

(which is obviously bad for stocks).

I realize that most financial advisors didn’t have “Global Sovereign Bond Markets” in their broker training program. But, this is what’s moving markets right now, so you need to be on top of it.

This research was already sent to our paid subscribers at 7 a.m. in the full, paid edition of The Sevens Report, and I’m confident some of them are using this analysis to impress clients and prospects.

Make sure you have a daily research document that gives you peace of mind in volatile markets.

We’ll directly tell you (in plain English) what’s truly important in markets and provide consistent tactical idea generation so you can outperform for your clients, regardless of the environment.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to

The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Added Research That Can Help You Grow Your Business in 2016

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report