Is Dis-Inflation Good For Stocks?

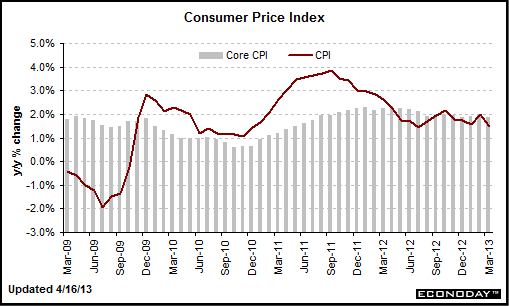

Yesterday was a pretty quiet day in the markets, but one consistent theme that showed up in economic data releases was something we’ve been ahead of the curve on here—and that’s the creep of dis-inflation and potential for deflation (Bloomberg had an article on it yesterday, link here), and I might add two weeks after we started pointing out the commodity crash was forecasting deflation).

Of particular note yesterday, then, was the latest release of the PCE Price Index, which is contained in the Personal Income and Outlays Report.

The PCE Price Index is a measure of inflation – but this one is extra important, because the PCE Price Index is widely assumed to be the Federal Reserve’s favorite measure of inflation. For March, the PCE Price Index rose only 1% year over year, with the “Core” PCE Price Index rising just 1.1% year over year (core excludes energy and food prices).

1% year-over-year inflation sounds great – but it isn’t. In fact, it’s something to be worried about. The Fed wants the year-over-year change in the PCE price index to be around 2%; that’s the level that is seen as healthy inflation.

But, 1% year-over-year increases in PCE Price Index is close to disinflation, which is really one step away from outright deflation – and that is really, really bad for the markets, economy, and risk assets.

The reason stocks were up yesterday is because that low reading on the PCE Price Index is seen as making the Fed continue its QE program for the foreseeable future. With inflation running so low, the view is that there’s no way the Fed would tighten policy and risk sparking deflation.

This trend is not exclusive the U.S. Yesterday, German CPI showed a 0.5% month-over-month decline in prices, and year over year, CPI rose just 1.2%. In Spain, prices rose just 1.5% year over year, falling sharply from last month’s 2.6% year-over-year gain. All of these year-over-year increases are 1) heading in the wrong direction, meaning the are going lower each month, and 2) well below the 2% inflation considered healthy by the ECB.

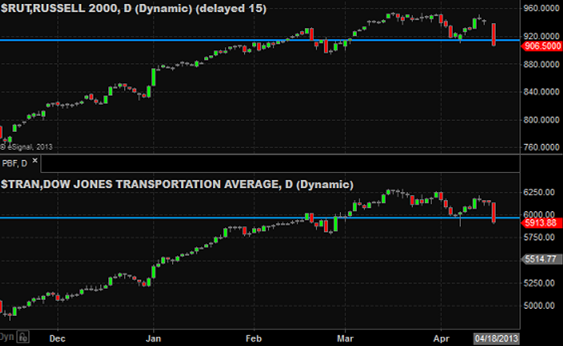

Markets have rallied since last week, despite the bad economic data, because it’s assumed the ECB and Fed will become even more accommodative to combat growing dis-inflation and potential deflation. So, we’re back to this perverse logic where increasing signs of deflation (which is really bad) is somehow good for stock prices in the immediate term because it promises constant QE and interest rate cuts.

But, while it has supported markets for over a week, this is not what we want. More QE is not good for the market in the medium/longer term. We have had enough QE! We need old-fashioned economic growth now—and the longer we go on without it, the greater the negative risks of QE programs become.

Getting bullish of stocks now, because of the prospects of more QE in reaction to a growing global deflation problem, is like hoping you catch pneumonia so you can stay home from school because you’re unprepared for a test. Yes—it solves the immediate problem in that you skip the test, but the risks of something bad happening simply aren’t worth it. The key to substantially higher stock prices over the medium term and longer term, and an economy that can actually grow at more than a snails pace for more than a few weeks, is less QE and more inflation—not more QE and deflation.